India started harnessing its wind power potential in the late 1980s and as of October 2022, the total wind power capacity installed in the country has reached 41.84 GW. The share of wind power in the total installed capacity mix in the country has increased from 21.1 GW in March 2014 to 40.3 GW in March 2022.

However, India has a significant number of old wind turbines that have already completed their design life while some are approaching the end of their design life. Repowering older, smaller wind turbines with higher capacity and higher efficiency turbines has been recognised as an important opportunity by the industry.

In a key policy measure that aims to promote repowering, the Ministry of New and Renewable Energy (MNRE), in October 2022, issued the draft National Repowering Policy for Wind Power Projects, 2022. Earlier, in 2016, the ministry had issued a policy for repowering of wind power projects. However, it failed to achieve the desired impact and the majority of old wind power projects with sub-MW-scale wind turbines are yet to be repowered.

The revised policy has been drafted taking into account representations from various stakeholders and subsequent deliberations. Notably, under the new policy, projects under 2 MW as well as those that have completed their design life will be eligible for repowering. The earlier 2016 policy allowed repowering of only those wind turbines that were below the capacity of 1 MW.

The new policy also specifies that the central/state governments could consider a scheme to provide additional financial incentives to developers for repowering projects. Further, the draft policy suggests that developers could sell additional wind power to discoms or through open access. Another key feature of the policy is that it gives additional renewable purchase obligation benefits to wind power projects undertaking repowering.

A look at the provisions outlined in the draft repowering policy and their expected impact…

Key policy highlights

Eligibility: Wind turbines that have less than 2 MW of capacity and have completed 90 per cent of their design life will be eligible for repowering. A set of existing wind turbines will be eligible for repowering if the project area is a contiguous land and all turbines are connected to a single pooling substation (PSS).

Project classification: A repowering project would be classified into two types — stand-alone project and aggregation project. A wind power project with a single or a group of wind turbines owned by a single entity will be referred as a standalone project while a wind power project that has a group of wind turbines owned by multiple owners with shared common infrastructure will be referred to as an aggregation project.

Implementation arrangements: State nodal agencies (SNAs) and central nodal agencies (CNAs) will be identifying the potential turbines for standalone projects for repowering, and project owners will submit the complete detailed project report (DPR) for old wind turbines to the SNA/CNA. Based on the DPR, the SNA/CNA will coordinate with the respective state transmission utility/central transmission utility for availability/augmentation of the transmission capacity, if required.

In the case of aggregation projects, the SNA/CNA will nominate any state/central public sector enterprise as wind repowering project aggregators (WRPAs) to repower the project or elicit interest from private developers. A private developer can also identify the potential turbines for repowering, and in this case the SNA or CNA must nominate the private developer as WRPA.

Setting up of a wind repowering committee: Within one month of the announcement of this policy, the MNRE will appoint a monitoring and advisory committee (named as the Wind Repowering Committee) to assist the MNRE in the implementation of the repowering policy.

PPA arrangement: The power generated corresponding to the average of the last three years’ generation prior to repowering will continue to be procured as per the terms of the power purchase agreement (PPA) till the PPA tenure. In case the PPA tenure is less than the standard PPA tenure of 25 years, the concerned discom will make arrangements to extend the tenure of the PPA for a period of 25 years from the date of commissioning of the original project and continue to procure the quantum of power generated (average of last three years’ generation) for the remaining tenure of the PPA. The project developers can sell additional wind power to the concerned discom or any other entity through open access subject to the refusal of the concerned discom. The power offtake by the concerned discom will be at the discovered tariff.

A wind farm/turbine undergoing repowering would be exempted from supplying power to the purchasing entity (discom) during the period of execution of repowering. Thus, the repowering period under the new policy has been limited to two years.

Further, the project developers could seek early termination by mutual consent of both the parties. The concerned discom will neither have any right over the additional power generated nor have any obligation to purchase the additional power generated after repowering.

In case of repowering of captive/third-party sale wind power project, the consumer will be allowed to purchase power from the grid (through discoms or any other available source) during the period of repowering. Further, the SNA/CNA may coordinate with the discoms for facilitating such connection/load for a temporary period.

Incentives and RPOs: For repowering projects, the Indian Renewable Energy Development Agency (IREDA) will provide an additional interest rate as rebate of 0.25 per cent over and above the interest rate available to the new wind projects being financed by IREDA.

In addition, the central or state government may consider a scheme to provide additional financial incentives to the projects being repowered in order to support the additional investment required for repowering (for decommissioning and acquisition of existing assets) in comparison to the greenfield projects. The repowering sites can also be considered under other relevant schemes available such as the renewable energy park scheme and avail of the benefits under the same. Further, the states where the repowering project is situated will be exempted from the wind renewable energy obligation till the commissioning of the repowered project. Also, an enhanced RPO multiplier will be provided to the repowered project.

Data management: The National Institute of Wind Energy (NIWE) will create and maintain a project database of all old projects with relevant information about the project such as ownership, technology, turbine details, connected PSS and land ownership. NIWE will also collect performance-related data for all the sites and identify the poor performing sites for repowering.

Challenges and outlook

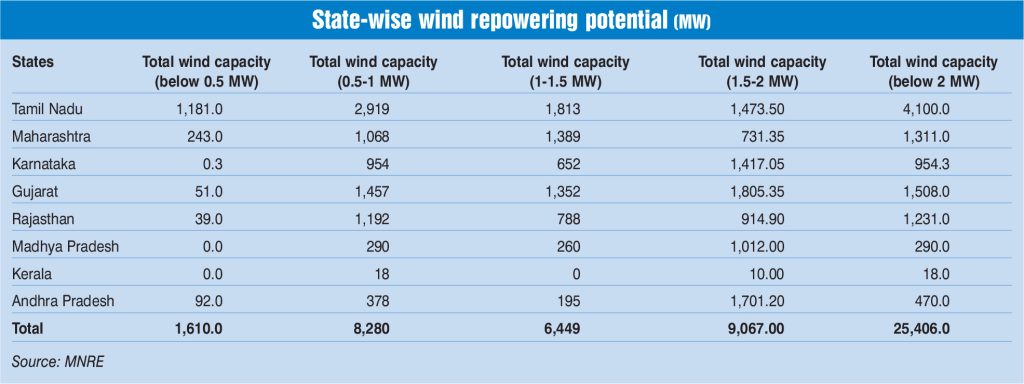

The NIWE has estimated the repowering potential of the country to be over 25 GW across eight states, comprising wind turbines of less than 2 MW capacity. Tamil Nadu has been identified as the state with the highest potential. However, some of the key issues and concerns that industry players have cited with regard to repowering are the costs and investments involved. The decommissioning and removal of old turbines, grid capacity enhancement and loss of generation from old wind turbines that have residual life add to the financial challenges.

Another area of concern is the inadequate transmission infrastructure for catering to the higher capacity repowered wind farms, which would need to be connected to 33 kV or 66 kV transmission lines as these are currently connected at the 11 kV level.

Also, there are concerns about getting discoms on board for signing PPAs for the additional power produced after repowering. Another challenge is getting different stakeholders on board for projects that have a shared infrastructure. Repowering a project would require negotiation of lease or sell arrangements with multiple land owners.

These challenges, notwithstanding, repowering presents a key opportunity for adding to the country’s wind capacity and improving the capacity utilisation factor. India plans to generate 500 GW of non-fossil energy by 2030, including 140 GW of wind power. Older turbines can be replaced with larger wind turbines with bigger rotors and longer blades to capture more wind energy. Thus, there is a huge scope for repowering wind power plants in India to ensure more energy generation and optimum utilisation of the country’s wind power potential.

If implemented properly, the new policy can provide the required impetus for the wind sector’s growth and encourage stakeholders to consider repowering their older wind turbines.