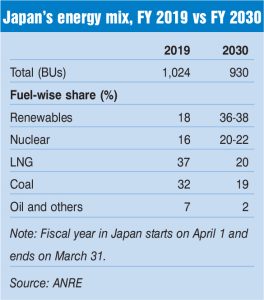

The Japanese electricity sector is in a state of flux as it strives to achieve its carbon neutrality goals by 2050. Decarbonising the power generation base is one of Japan’s top priorities and it is increasingly positioning renewables as the main source of energy in the future. This is despite certain issues that are unique to the country – a high dependence on LNG imports due to the lack of fossil fuel resources; the unavailability of flat areas, which limits renewable energy expansion; and no cross-border transmission interconnections for power trade with neighbouring countries. Further, the recent global surge in energy prices due to the Ukraine war has significantly impacted power supply in Japan. Therefore, it is planning to bring nuclear back into its fold to address energy security concerns. With the Japanese government targeting to increase the share of non-fossil fuel energy (renewable and nuclear) in total generation to 59 per cent by financial year 2030 from 24 per cent in financial year 2019, a major transformation is under way in the electricity sector.

The power transmission and distribution (T&D) segment has a vital role to play in supporting this objective as electricity networks need to be overhauled to strengthen Japan’s ageing power grid so that they can evacuate large-scale renewables while maintaining grid stability and resilience. To this end, the 10 general power T&D companies in Japan that make up the Grid Council have drawn up a plan, “Toward Carbon Neutrality by 2050 – Roadmap to the Next Generation of Power Networks”.

Power Line takes a look at Japan’s energy policy goals and plans to build power networks of the future.

Energy and environment policy goals

In October 2020, the then Japanese prime minister Suga Yoshihide announced the ambitious goal of making Japan carbon-neutral by 2050. In April 2021, it was declared that Japan would seek to reduce its greenhouse gas emissions by 46 per cent by financial year 2030 from its 2013 levels, and would thereafter further strive towards a 50 per cent reduction. To meet these goals, the government approved the Sixth Strategic Energy Plan in October 2021, which stipulates that thermal power generation will be reduced from about 76 per cent in financial year 2019 to about 41 per cent by financial year 2030.

The “Green Growth Strategy toward Carbon Neutrality by 2050” announced by the Ministry of Economy, Trade and Industry in December 2021 has set decarbonisation of the electric power sector as a major goal. It proposed a policy to promote decarbonisation of power sources such as maximum introduction of renewable energy while promoting “electrification” in non-electrification of the industrial, transportation and household sectors.

A new philosophy of S+3E (safety, energy security, economic efficiency and environment) was also introduced to strive towards the 2030 commitments by working to make renewable energy the main source of power generation, restarting nuclear power plants with a focus on safety, and reducing the dependence on thermal power generation as much as possible by phasing out inefficient thermal power generation.

Recently, in November 2022, the Japanese government proposed plans to allow some nuclear reactors to operate beyond the current 60-year limit and develop next-generation innovative reactors that incorporate new safety mechanisms. To recall, after the 2011 earthquake-triggered tsunami disaster at the Fukushima nuclear power plant, the operational life of Japan’s nuclear reactors was limited to 40 years with a possible one-time extension of up to 20 years, under stricter safety protocols.

Electricity industry structure

Historically, Japan’s electricity system was fragmented into 10 areas, operated by vertically integrated electric power companies (EPCos), which had a monopoly in their own areas. There was one EPCo each for Tokyo, Hokkaido, Tohoku, Chubu, Hokuriku, Kansai, Chugoku, Shikoku, Kyusyu and Okinawa regions. Electric Power Development Company Limited, or J-Power, is the only utility that operates at the national level. Although independent generators have been allowed to operate since liberalisation in 1995, their participation has been low.

This was followed by a partial liberalisation of the retail sector in 2000-05, when power producers and suppliers were granted the right to sell electricity to larger consumers using the EPCos’ transmission networks. The Japanese Electric Power Exchange was established in 2003 to encourage greater power exchange. However, competition remained limited by regional boundaries with EPCos controlling both generation and distribution.

The Japanese government began a massive reform exercise of its electricity sector under three stages. The first stage of the reform policy was accomplished by April 2015, with the establishment of the Organisation for Cross-regional Coordination of Transmission Operators to enhance control over the supply-demand balance of electricity in both normal and emergency situations on a nationwide basis. The second stage of the reform, which fully opened retail-level competition in the Japanese electricity market, was accomplished by April 2016.

The Electricity and Gas Market Surveillance Commission (formerly Electricity Market Surveillance Commission, which was formed in September 2015 but changed its name in April 2016 with the addition of the gas surveillance function) is responsible for granting electricity retailer licences and supervising electricity retailers to ensure their compliance.

The third and final stage of reforms, which called for the legal separation of transmission and distribution from generation and retail, was implemented in April 2020, resulting in the spin-off of new T&D companies from the former general electricity utilities. All EPCos have legally unbundled choosing either a holding company approach and/or a format of affiliated companies. Since April 2020, the new electricity T&D companies act as transmission service operators and are responsible for grid management. Meanwhile, the retail market has over 700 retailers though the retail arms of former EPCos still dominate the retail market. However, the share of retailers is gradually increasing.

Focus on power networks

Japan realises that the transformation of electricity T&D networks is essential to support the decarbonisation of power generation. The 10 T&D companies that are part of the Grid Council – Hokkaido Electric Power Network Co. Limited; Tohoku Electric Power Network Co. Limited; TEPCO Power Grid, Inc.; Chubu Electric Power Grid Co. Limited; Hokuriku Electric Power Transmission and Distribution Co. Limited; Kansai Electric Power Transmission and Distribution Co. Limited; Chugoku Electric Power Network Co. Limited; Shikoku Electric Power Transmission and Distribution Co. Limited; Kyushu Electric Power Transmission and Distribution Co. Limited; and Okinawa Electric Power Co., Inc.) have been working with the federal government as well as wide-area power management agencies to develop a T&D grid that can accommodate the growing share of renewables and support the electrification of other industries. Some of the key measures identified for the development of the next-generation power network are discussed below.

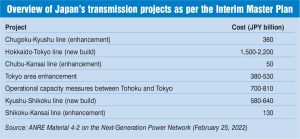

Removing grid constraints: Efforts to overcome grid constraints are essential to make renewables the main power source. Japan’s Agency for Natural Resources and Energy (ANRE) is working on a master plan for the development of a wide-area interconnection system across the country to enable renewable power evacuation and improve grid resilience. An interim report of the master plan was completed in May 2021 and the plan is expected to be completed by the end of 2022. As per the interim report, grid enhancements and new transmission infrastructure for about 45 GW of unevenly distributed renewable energy sources (such as offshore wind) would require investments of around JPY 3.8 trillion-JPY 4.8 trillion. Some key projects include Chugoku/Kyushu enhancement (JPY 360 billion), Hokkaido/Tokyo new build (JPY1.5 trillion-JPY 2.2 trillion), Chubu/Kansai enhancement (JPY 50 billion), Tokyo area enhancement (JPY 380 billion-JPY 530 billion), operational capacity measures between Tohoku and Tokyo (JPY 700 billion-JPY 810 billion), Kyushu-Shikoku new build (JPY 580 billion-JPY 640 billion), and Shikoku-Kansai enhancement (JPY 130 billion). Also, there are plans to build interconnections between Hokkaido Honshu, Tohoku-Tokyo, and central Tokyo by financial year 2027.

Revenue cap mechanism: The Japanese transmission segment needs considerable investment to upgrade its ageing grid to deal with the changing generation mix as well as the increasing incidence of climate-related disasters such as typhoons and floods. With bidirectional flow of electricity anticipated in the coming years and the introduction of electric vehicles (EVs), it will be necessary to invest in next-generation digital technologies such as artificial intelligence and internet of things as well as strengthen cybersecurity measures. To promote investment in the segment, a new network tariff regulation system called “revenue cap” is planned to be introduced in financial year 2023. Under this, transmission service operators will be required to achieve both maximum cost efficiency and sufficient investment towards a resilient T&D network.

Application for transmission connectivity: Since building and strengthening transmission networks is a time-intensive process, ANRE began to accept applications for “non-firm type connections” from January 2021 onwards to connect renewable energy plants to the grid. The grid connection, in these cases, is provided on the condition that the generation output will be controlled/restricted if there is congestion in the transmission network. However, going forward, as renewables displace other sources of power to become the main source, it will be necessary to review the connection process. With respect to application for connectivity to local grids, ANRE is planning to accept applications around the end of financial year 2022.

Digitalisation and distributed energy systems: Japan aims to adopt digital technologies to build a next-generation power network that is stable, resilient, efficient and cost effective. There are plans to deploy sensors for the operation and maintenance of T&D facilities, advanced system operation and congestion management using distributed energy resources in distribution networks, smart meters, power distribution automation system, regional microgrid using digital technology, and adaptive under frequency relays (for avoiding blackouts). Further, considering the large-scale addition of renewable energy and increasing electrification of the transportation sector, it is imperative to create a grid that supports such a distributed energy system. Steps are being taken in this respect by improving the resilience of local power supply, deepening the business of local production and local consumption of regional renewable energy, and introducing large amounts of renewable energy efficiently. In the revenue cap system, a distributed energy system is listed as one of the specific “target items” that general power T&D companies should achieve.

The Japanese market is witnessing the growth of aggregators that depend on a large number of distributed power sources (solar PV, EVs, etc.) and peer-to-peer transactions amongst consumers. To respond to these changes, it may be necessary to create a supply and demand adjustment market, reform the electricity metering system and streamline related regulations.

Congestion management: Currently, the first come, first served rule is applied for congestion management in the Japanese grid, that is, plants that are connected later are regulated first. Since power generation from coal-fired power plants has been connected to the grid for a long time, it is prioritised to renewable energy with non-firm connection. However, ANRE is now looking at introducing market-driven models for congestion management as well as review of grid usage rules.

Standardisation of facilities and systems: Since the development of next-generation power systems requires significant investment, standardisation of material/component specifications has the potential to expand economies of scale. This can help reduce costs by joint procurement as well as reduce manufacturers’ cost of production associated with individual specifications. Standardisation also offers the benefit of exchanging materials/components in case of emergency/disaster or supply change issues. In 2019, the specifications of overhead transmission lines, gas circuit breakers and underground cables were standardised. Going forward, the specifications of pylons, electric wires, cables, transformers and co-ncrete poles will be standardised followed by gas-insulated switchgear and high voltage switches.

Others: To support each other in the event of a disaster, the 10 general power T&D companies will jointly prepare a plan for the early restoration of power outages, cooperate in the event of a disaster, and establish relationships with the local governments.

Conclusion

Japan’s roadmap for building next-generation power networks is still a work in progress, but those reforms and initiatives undertaken and planned so far are expected to aid in creating a resilient power grid that can support the country’s decarbonisation goals.