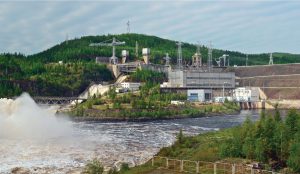

Hydropower, as a source of green energy brings advantages such as energy storage, flexibility and continuous power generation, effectively addressing peak-hour demands. The hydropower segment is crucial for fulfilling climate change commitments and reaching the nation’s goals for renewable energy capacity. Currently, with an installed capacity of around 52 GW, hydropower accounts for a share of 12 per cent of the country’s energy mix. Moreover, it is anticipated to play a pivotal role in upholding grid stability in the evolving energy landscape. Pumped storage plants (PSPs) are gaining popularity for their ability to provide peaking power and maintain system stability within the power grid.

Hydropower, as a source of green energy brings advantages such as energy storage, flexibility and continuous power generation, effectively addressing peak-hour demands. The hydropower segment is crucial for fulfilling climate change commitments and reaching the nation’s goals for renewable energy capacity. Currently, with an installed capacity of around 52 GW, hydropower accounts for a share of 12 per cent of the country’s energy mix. Moreover, it is anticipated to play a pivotal role in upholding grid stability in the evolving energy landscape. Pumped storage plants (PSPs) are gaining popularity for their ability to provide peaking power and maintain system stability within the power grid.

In order to support capacity addition in the segment, a number of policy measures and reforms have been announced. In April 2023, the Ministry of Power (MoP) issued guidelines to promote the development of PSPs, which include provisions for exemption from free power obligations and rationalisation of environmental clearances. Further, the MoP has announced the waiver of interstate transmission system (ISTS) charges for new hydroelectric projects (HEPs) and PSPs. In another development, in order to revive stalled projects, the Arunachal Pradesh government recently handed over 12 HEPs aggregating over 11 GW to the central PSUs, including NHPC Limited, SJVN Limited and North Eastern Electric Power Corporation Limited (NEEPCO).

Size and growth

As of August 2023, the total installed large hydropower capacity in the country stood at 46,850.17 MW. This comprises 212 HEPs, with an aggregate installed capacity of 46.8 GW, including eight PSPs of approximately 4.7 GW. If small hydropower is factored in, the overall installed hydro capacity reaches 51,832.92 MW, accounting for a 12.2 per cent share of the total installed capacity in the country. Between 2018-19 and 2022-23, the installed thermal power capacity grew at a compound annual growth rate of 1.2 per cent, while hydropower grew at 0.8 per cent. In terms of generation, hydropower plants generated 162 BUs of electricity in 2022-23, approximately 7 per cent more than in the previous year. During April-August 2023, hydropower generation stood at nearly 74.4 BUs, reflecting a decrease of approximately 8.4 per cent compared to the same period in the previous year.

comprises 212 HEPs, with an aggregate installed capacity of 46.8 GW, including eight PSPs of approximately 4.7 GW. If small hydropower is factored in, the overall installed hydro capacity reaches 51,832.92 MW, accounting for a 12.2 per cent share of the total installed capacity in the country. Between 2018-19 and 2022-23, the installed thermal power capacity grew at a compound annual growth rate of 1.2 per cent, while hydropower grew at 0.8 per cent. In terms of generation, hydropower plants generated 162 BUs of electricity in 2022-23, approximately 7 per cent more than in the previous year. During April-August 2023, hydropower generation stood at nearly 74.4 BUs, reflecting a decrease of approximately 8.4 per cent compared to the same period in the previous year.

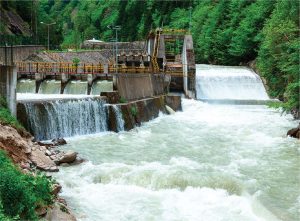

Currently, India’s PSP capacity stands at 4,745.6 MW across eight plants. Meanwhile, four PSP schemes totalling 2,780 MW are under construction and over 52 GW across 41 projects is under survey and investigation, as per the Central Electricity Authority.

Key recent developments

Policy/Regulatory interventions: In December 2022, the MoP issued an order for the waiver of ISTS charges on the transmission of electricity generated from new HEPs, for construction work awarded and PPAs signed on or before June 30, 2025. The waiver/concessional charges will be applicable for a period of 18 years from the date of commissioning of the hydropower plants. Furthermore, the MoP has declared any tax/duty on the generation of electricity as illegal and unconstitutional. It stated that HEPs do not consume water to produce electricity, so the imposition of tax on non-consumptive use of water from these rivers for electricity generation is in violation of the provisions of the Constitution of India.

The hydropower segment is crucial for fulfilling climate change commitments and achieving the country’s goals for renewable energy capacity.

Additionally, the Central Electricity Regulatory Commission permitted the introduction of hydropower contracts in green contingency and green term-ahead contracts at the Hindustan Power Exchange with effect from January 11, 2023. In March 2023, the MoP released a report to examine contractual issues and different modes of contracting in HEPs. As per the report, the choice of mode for the contracting package should be made on a case-to-case basis, considering factors such as the project’s nature, cost, and clearance status, as well as law and order. Therefore, a one-size-fits-all approach may not be appropriate and the decision should be left to the developer of the project.

In April 2023, the MoP released guidelines to promote PSPs in the country. These guidelines propose market reforms to incentivise ancillary services provided by PSPs, exempt them from free power obligations and streamline environmental clearances for such projects. To facilitate the early development of projects, state governments can directly award projects to hydro central or state PSUs on a nomination basis. PSP projects can also be awarded to private developers through a two-stage competitive bidding process. The Ministry of Environment, Forest and Climate Change, in May 2023, amended the environmental impact assessment notification of 2006 to ease the process of environment clearances for PSPs.

Project updates: In August 2023, NHPC and Andhra Pradesh Power Generation Corporation Limited entered into an MoU for the implementation of PSPs and renewable energy projects in Andhra Pradesh. In the first phase, the MoU envisages the implementation of two identified PSPs, Kamlapadu (950 MW) and Yaganti (1,000 MW), aggregating 1,950 MW. During the same month, Tata Power and the Maharashtra government signed an MoU to develop two large PSPs with a combined capacity of 2,800 MW. These projects will be located at Shirawta, Pune (1,800 MW), and Bhivpuri, Raigad (1,000 MW), and will entail an estimated investment of Rs 130 billion.

Additionally, the Arunachal Pradesh government signed memorandums of agreement with hydro PSUs to execute 12 stalled HEPs in the state with a cumulative installed capacity of approximately 11,517 MW in August 2023. Of these, five projects with 2,620 MW have been allocated to NEEPCO, five projects with 5,097 MW to SJVN and the remaining two projects with 3,800 MW to NHPC. These projects are expected to bring an estimated investment inflow of approximately Rs 1,265 billion to Arunachal Pradesh.

In June 2023, NHPC and the Maharashtra government signed an MoU for the development of four PSPs aggregating 7,350 MW of capacity. These projects are Kalu (1,150 MW), Savitri (2,250 MW), Jalond (2,400 MW) and Kengadi (1,550 MW). The projects will attract an investment of about Rs 440 billion. During the same month, Torrent Power Limited signed an MoU with the Maharashtra government for developing three PSPs with a total capacity of 5,700 MW. The projects will be executed at Karjat in Raigad district (3,000 MW) and Maval (1,200 MW) and Junnar (1,500 MW) in Pune district at an investment of approximately Rs 270 billion over five years.

While the hydro segment has traditionally been dominated by the public sector, PSPs are increasingly attracting private interest and investment.

In April 2023, the Arunachal Pradesh government launched an ambitious plan to build 50 mini HEPs for the electrification of remote villages. These projects of 10-100 kW capacities will be built at an estimated cost of Rs 2 billion under the Golden Jubilee Border Village Illumination Programme and implemented in a phased manner.

In February 2023, the central government approved an estimated investment of Rs 318.76 billion for the 2,880 MW Dibang multi-purpose project to be developed in Arunachal Pradesh by NHPC.

In January 2023, the Cabinet Committee on Economic Affairs approved an estimated investment of Rs 26.15 billion for the 382 MW Sunni Dam HEP in Himachal Pradesh by SJVN.

Issues and challenges

Issues and challenges

The full development of India’s hydroelectric potential, while technically feasible, faces numerous challenges. These include issues relating to water rights, environmental considerations, the absence of financially stable civil contractors, challenges associated with resettlement and rehabilitation, and unexpected geological conditions. These factors often result in significant delays and cost overruns for HEPs. In addition, much of the hydroelectric potential in the country lies in climate-vulnerable regions. Recently, the Meghalaya government approved the termination of two HEPs, the Kynshi Stage I HEP on the Kynshi river in the West Khasi Hills and the Upper Khri HEP Stages I and II, due to financial non-viability and high rates and delays in implementation. To address this issue, the government has established a standing technical committee to study issues in the event of any geological surprises in HEPs and to vet/examine and recommend additional time or cost adjustments.

The way forward

With regard to the upcoming hydro capacity, a significant portion of the additions will come from PSPs, given their crucial role in providing round-the-clock reliable power supply. Currently, there are over 14 GW of projects at the planning and development stages. While the hydro segment has traditionally been dominated by the public sector, PSPs are increasingly attracting private interest and investment. Notably, hydropower is also important for regional energy cooperation in South Asia, especially among the BBIN countries (Bangladesh, Bhutan, India and Nepal). With the commissioning of under-construction and upcoming HEPs, hydro imports and exports are expected to increase in the coming years.

PSPs are gaining popularity for their ability to provide peaking power and maintain system stability within the power grid. A significant portion of the upcoming hydro capacity will come from PSPs, given their crucial role in providing round-the-clock reliable power supply

Going forward, as per the National Electricity Plan, 2023, the installed hydro capacity is expected to reach 88 GW (including 26 GW from PSPs) by 2031-32. This is estimated to entail a total fund requirement of Rs 3.2 trillion. However, to accelerate the pace of capacity addition in this sector, it is crucial to address challenges such as long construction periods, delays in granting environmental clearances and difficulties in land acquisition. Additionally, HEPs need to be equipped with adequate disaster management and mitigation technologies and solutions.

Akanksha Chandrakar