Grid-scale energy storage solutions are increasingly gaining traction and need to grow significantly to support the rising renewable energy capacity in the country. There is an impetus from the government to mainstream energy storage solutions through conducive policies. In addition, in recent times, tenders for firm and despatchable renewable energy with energy storage systems (ESSs) have witnessed traction.

Grid-scale energy storage solutions are increasingly gaining traction and need to grow significantly to support the rising renewable energy capacity in the country. There is an impetus from the government to mainstream energy storage solutions through conducive policies. In addition, in recent times, tenders for firm and despatchable renewable energy with energy storage systems (ESSs) have witnessed traction.

The Ministry of Power (MoP) has issued the National Framework for Promoting Energy Storage Systems. The initiative aligns with the country’s commitment to deploy renewable energy sources and reduce greenhouse gas emissions. The primary goal of this framework is to encourage the use of ESSs while reducing the reliance on fossil fuel power plants. It provides several policy measures and incentives, such as estimated requirements for energy storage, a waiver of inter-state transmission system (ISTS) fees for ESS usage, regulations for BESS power procurement, and the inclusion of ESS in the harmonised master list of infrastructure.

More recently, in September 2023, the union cabinet approved a viability gap funding (VGF) of Rs 37.6 billion for a total capacity of 4,000 MWh. Through the VGF, the government intends to reduce the cost of battery storage from the current level of Rs 10 per kWh to Rs 5.50 – Rs 6.60 per kWh by 2030-31.

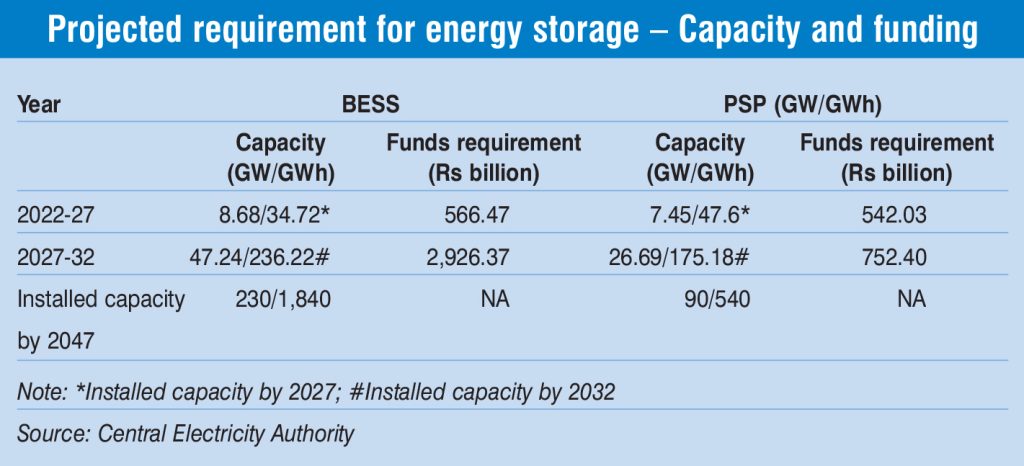

Notably, India requires large volumes of energy storage solutions to support its renewable energy, energy transition and net-zero goals. As per the National Electricity Plan 2023, India’s energy storage capacity requirement is projected to reach 16 GW/82 GWh (7 GW/48 GWh for pumped storage plants [PSPs] and 9 GW/35 GWh for battery energy storage systems [BESS]) in 2026-27; 74 GW/411 GWh (27 GW/175 GWh PSP and 47 GW/236 GWh for BESSs) in 2031-32, and 320 GW/2,380 GWh (90 GW/540 GWh for PSPs and 230 GW/1,840 GWh for BESSs) in 2047. In terms of funding requirement, during 2022-27, PSPs and BESSs will require an estimated Rs 542 billion and Rs 566 billion respectively. Further, for the period 2027-32, the funds requirement for PSPs and BESSs is estimated to be Rs 752 billion and Rs 2,926 billion respectively.

National Framework for Promoting Energy Storage Systems

The MoP’s National Framework for Promoting Energy Storage Systems ratifies various policies and provisions that have encouraged the planning and establishment of ESSs in the country. Additionally, it proposes various incentives to encourage the development of ESSs going forward. The comprehensive framework is a significant step forward in developing ESSs and will facilitate a conducive ecosystem for its growth.

To ensure adequate storage capacity, the framework proposes that new renewable energy projects (excluding hydropower) with an installed capacity of over 5 MW (or as specified by the central government) may be mandated to install an ESS (with at least 1 hour of storage) for a minimum 5 per cent of the renewable energy capacity. This ESS capacity can be considered at the bidding stage and can be either colocated with the renewable energy project or be located elsewhere. The framework also proposes various incentives, including financial incentives such as VGF for BESS projects (notified in September 2023), additional budgetary support for enabling PSP infrastructure, green finance and long-term financing by REC Limited, Power Finance Corporation Limited and the Indian Renewable Energy Development Agency; carbon credit issuance for storage systems utilising renewable energy; prioritised connectivity on the ISTS; electric duty and cross-subsidy surcharge waivers on input power; exemptions from stamp duty and registration fees on acquired land; and production-linked incentives and approved list of models and manufacturers schemes for BESS.

Viability gap funding for BESS

Viability gap funding for BESS

In a much-awaited policy measure to promote the development of BESS in the country, the union government, in September 2023, approved the Scheme for Viability Gap Funding for the development of BESS. The scheme envisages the development of 4,000 MWh of BESS projects by 2030-31, with financial support of up to 40 per cent of the capital cost as budgetary support to reduce the cost of battery storage systems, thus increasing their viability.

With an initial outlay of Rs 94 billion (including budgetary support of Rs 37.6 billion), the scheme aims to achieve a levellised cost of storage of Rs 5.50-Rs 6.60 per kWh. In order to ensure that the scheme’s benefit reaches the end consumer, it stipulates that a minimum of 85 per cent of the BESS project capacity under the scheme will be made available to discoms.

Recent tendering activity for FDRE

There has been a surge in tenders for renewable energy with energy storage. Most recently, on September 30, 2023, NHPC Limited invited bids for 1.5 GW of firm and despatchable renewable energy (FDRE) from ISTS-connected renewable energy, along with energy storage system projects anywhere in India, under tariff-based competitive bidding. Earlier, SJVN Limited had issued a tender to develop ISTS-connected renewable energy projects along with storage with a total capacity of 1,500 MW anywhere.

Earlier, in August 2023, under Rajasthan Urja Vikas Nigam Limited’s (RUVNL) tender for 600 MW of solar plus storage capacity, ACME Solar (500 MW) and Solarcraft Power (100 MW) emerged as winners at a tariff of Rs 6.69 per unit and Rs 6.68 per unit respectively. In December 2022, in Maharashtra State Electricity Distribution Company Limited’s (MSEDCL) auction for 250 MW of renewable power with energy storage, Ayana Renewable Power Private Limited (150 MW) and NTPC Renewable Energy Limited (100 MW) emerged as winners with a winning tariff of Rs 9 per unit. Earlier, in December 2022, Greenko Energies Private Limited had secured NTPC’s ISTS-connected 3,000 MWh energy storage system with a minimum capacity of 500 MW at Rs 2.8 million per MWh per year, while JSW Renew Energy won Solar Energy Corporation of India Limited’s (SECI) auction for 500 MW/1,000 MWh of standalone BESSs at Rs 1.1 million per MW per month for 12 years.

Focus on pumped storage projects

Pumped storage is currently the most mature and affordable energy storage technology. This segment is witnessing massive uptake, with the announcement of GW-scale PSPs across the country. The need for large grid-scale ESSs in light of the growth of renewable energy sources is a key driver for the segment’s expansion. The government has also implemented various measures to promote its growth, such as the waiver of ISTS charges, guidelines for PSPs and budgetary support of Rs 10 million-Rs 15 million per MW for the construction of roads and bridges by hydropower project developers (including PSPs). Furthermore, several state-level initiatives, such as those in Madhya Pradesh and Andhra Pradesh, are expected to give a fillip to the PSP segment.

Several private sector developers have announced plans and signed agreements with state governments to develop PSPs. These upcoming projects include two Tata Power PSPs aggregating 2,800 MW in Maharashtra; Torrent Power’s three PSPs aggregating 5,700 MW in Maharashtra; and Adani Green Energy Limited’s PSPs aggregating 1,600 MW, and JSW Neo Energy Limited’s two PSPs aggregating 3,000 MW in Almora, Uttarakhand.

In addition, NHPC has signed MoUs with state gencos to develop PSPs. These include MoUs with Andhra Pradesh Power Generation Corporation Limited to develop two pumped hydro storage projects aggregating 1,950 MW (the 950 MW Kamlapadu and the 1,000 MW Yaganti projects), and with the Odisha government through Grid Corporation of Odisha Limited to set up self-identified PSPs of at least 2,000 MW capacity in the state. Overall, according to Power Line Research, Maharashtra, Andhra Pradesh and Madhya Pradesh have the largest pipeline of PSPs. Projects with a total capacity of 80 GW have been announced and 6 GW of capacity is under construction.

Power Generation Corporation Limited to develop two pumped hydro storage projects aggregating 1,950 MW (the 950 MW Kamlapadu and the 1,000 MW Yaganti projects), and with the Odisha government through Grid Corporation of Odisha Limited to set up self-identified PSPs of at least 2,000 MW capacity in the state. Overall, according to Power Line Research, Maharashtra, Andhra Pradesh and Madhya Pradesh have the largest pipeline of PSPs. Projects with a total capacity of 80 GW have been announced and 6 GW of capacity is under construction.

With the growing interest in ESSs, and specifically PSPs, the concept of integrated renewable energy storage projects (IRESPs), that is, the colocation of various renewable energy projects such as solar and wind and PSPs, is emerging. Industry estimates suggest that the weighted average cost of energy from storage and directly from generation for an IRESP is Rs 4-Rs 4.50 per unit. Notably, India’s first IRESP – Greenko’s 1,200 MW Pinnapuram IRESP in Andhra Pradesh — is expected to be commissioned in 2024.

Conclusion

While the policy push for promoting energy storage solutions has been impressive, technological advancements for standalone energy storage to become economically viable is imperative. As long as the cost of energy storage systems remains high, their adoption will remain limited.

Net, net, as the country embarks on a massive expansion of renewable energy, scaling up energy storage is imperative to address intermittency challenges and ensure grid stability.

Priyanka Kwatra