As investment opportunities in India’s conventional power segment dry up, a growing number of power companies are looking at outbound investments and forays into new and emerging markets. In recent years, power-starved Bangladesh has become one of the promising markets for Indian power majors to tap into.

During the Bangladesh prime minister’s visit to India in April this year, companies from both countries signed agreements worth more than $9 billion, the majority of which were in the energy segment. These include deals by power majors such as NTPC Limited, Reliance Power and Adani Power, which plan to set up nearly 3,700 MW of capacity for power generation and supply to Bangladesh. In addition to generation companies, diverse companies across the value chain are actively exploring opportunities, setting up joint ventures (JVs) in each other’s country or winning contracts in the Bangladesh power sector.

Explaining the trend behind Bangladesh emerging as a preferred investment destination for Indian investors, Yogesh Daruka, partner, PricewaterhouseCoopers, says, “The Government of Bangladesh realises the need to attract private sector investment in the power sector and has taken several initiatives to make the country an attractive investment destination. For many cost-competitive Indian corporates, Bangladesh is becoming an alternative investment destination with easy access and efficient logistics and delivery facilities.”

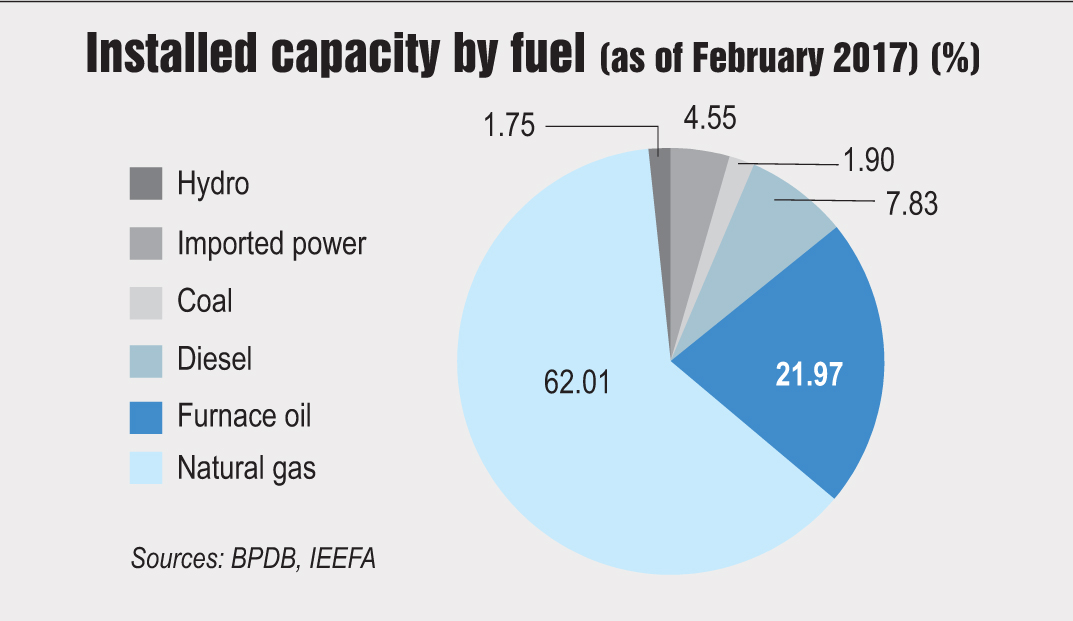

Bangladesh’s power sector faces a number of challenges such as demand-supply shortfall, poor distribution infrastructure, heavy dependence on gas-based projects and expensive power from rental power plants. Under the Bangladesh Power Sector Master Plan (PSMP) launched in 2016, the government wants to revamp the power sector over the next 25 years, through a number of strategies such as diversifying its fuel source, stepping up cross-border energy purchases, among other things. “Indian investors can view the Bangladesh power market as a great opportunity to explore new investments in power generation, renewable energy, transmission and distribution,” notes Ajit Pandit, director, Idam Infrastructure Advisory.

What is the current power scenario in Bangladesh? What are some of the investments proposed by Indian companies? What is the investment potential in the country? Power Line takes a closer look…

Current infrastructure in Bangladesh

As per a report by the Institute for Energy Economics and Financial Analysis (IEEFA), Bangladesh’s electricity sector has been plagued by a mismatch between demand and supply owing to gas availability issues in a virtually single fuel-dependent electricity system and a strong demand growth and insufficient investment in new generating capacity.

Further, despite having large gas reserves, Bangladesh has not been able to produce enough gas to meet demand. This demand-supply gap has led to a situation in which power capacity of nearly 603 MW lacks fuel, resulting in frequent power cuts. Another issue has been the frequent shutdowns of a large segment of the country’s installed capacity (almost 10 per cent) for long-term maintenance.

As per the IEEFA, Bangladesh also suffers from power transmission issues, owing to its fragile grid, struggling to both modernise and cope with the strong growth in demand for electricity, which reaches about 74 per cent of the population. Bangladesh faced a major blackout due to grid failure in 2014. Since then, grid problems have persisted, though of lesser magnitude. Further, the average cost of electricity production has increased steadily, putting pressure on the troubled power system. The Bangladesh Power Development Board (BPDB) has also posted massive losses. Further, subsidised power to certain consumer segments is distorting the free market.

Opportunities aplenty

Bangladesh is planning to invest significantly in ramping up the country’s power infrastructure. Nearly $16 billion is envisaged to be invested in the Bangladesh power sector in order to achieve its “Power for All” vision by 2021.

Further, the PSMP 2016, which lays out the roadmap for the country’s power sector for the next 25 years till 2041, signifies huge opportunities in the sector in a variety of areas. Enhancement of infrastructure for importing energy, efficient development and utilisation of domestic natural resources (coal and gas), construction of a robust and high quality power network, maximisation of green energy and its promotion, improvement of human resources and the mechanism related to stable supply of energy are the key areas that the plan focuses on. These plans are expected to provide a good opportunity to Indian developers; original equipment manufacturers; engineering, procurement and construction players; and technical service providers in the coming years.

Also, the Bangladesh government plans to set up power hubs in the southern part of the country (in areas like Maheshkhali and Matarbari), which offers large potential to Indian private players for partnership. Further, Bangladesh’s target of achieving 10 per cent renewable energy in its generation mix by 2021 as well as the conducive policy and regulatory framework being put in place through the Sustainable and Renewable Energy Development Authority (SREDA) and the Bangladesh Energy Regulatory Commission are expected to create investment opportunities for renewable energy investors. In addition to these measures by the Bangladesh government, the cross-border guidelines issued by the Indian power ministry in December 2016 have brought in greater clarity for generators and traders, and are conducive to expanding power trade between the two countries.

Cross-border trading plans

Since 2013, Bangladesh has been importing 500 MW of electricity from India through grid interconnectivity between Baharampur in West Bengal, India and Bheramara in Bangladesh. Under the deal, Bangladesh gets 250 MW of electricity through NTPC’s subsidiary, NVVN Limited, and the remaining 250 MW from PTC India.

In March 2016, the cross-border trade was increased by another 100 MW, with power exports from Tripura. Under the pact, the power generated by ONGC Tripura Power Company’s project in Palatana is exported to Bangladesh.

NVVN Limited now plans to supply more power to the country. In an agreement concluded recently between NVVN and BPDB, another 60 MW will be supplied from Tripura to Bangladesh.

Another preliminary pact with BPDB was signed this year for power supply from Nepal. As per news reports, a proposal is under consideration for the supply of 300-400 MW of power by NVVN to Bangladesh from GMR Energy’s upcoming hydropower project (Upper Karneli) in Nepal.

Another proposal in the pipeline is PTC India’s plan to supply 400 MW from an imported coal-based power project in Haldia in West Bengal. The company had made the offer last year for power supply at a tariff of BDT 6.81 per unit.

Other major proposals

On the generation front, one of the key agreements concluded between the two countries was a $1.6 billion financing deal between India’s Exim Bank and NTPC’s Bangladesh arm for the Maitree project in Bangladesh. The 1,320 MW coal-based project is being set up at Rampal in Bagerhat district by Bangladesh-India Friendship Power Company Limited, a 50:50 JV company of NTPC and BDPB. The project is expected to be commissioned by 2019-20.

India’s largest power equipment company, Bharat Heavy Electricals Limited (BHEL) won the equipment supply contract for this project recently through a stiff international competitive bidding process. The $1.49 billion contract, for setting up two 660 MW supercritical units, is the equipment company’s largest overseas project till date. BHEL has also won contracts for several other projects in the country in the past, the first of which was a 100 MW gas turbine power project set up in 2001.

Private sector major Reliance Power (RPower) too recently signed a power purchase agreement (PPA) with BPDB to get the first phase of its proposed power project and liquid gas import terminal in Bangladesh off the ground in less than two years of signing the MoU. Back in June 2015, RPower and BPDB had signed the MoU for the three-phase project, together worth $3 billion. The $1 billion investment in the first phase of 750 MW capacity will mark the single-largest foreign direct investment in Bangladesh. The power plant will be set up in Narayanganj district’s Meghnaghat area and the floating gas import terminal at Kutubdia Island in Chittagong. BPDB has provided land for the power station. RPower plans to move the equipment it had imported from equipment supplier GE for the 2,400 MW plant earlier proposed at Samalkot in Andhra Pradesh to Bangladesh.

Adani Power has also signed a $2 billion pact with BPDB and a PPA with the Power Grid Company of Bangladesh for the supply of 1,600 MW of power produced in Jharkhand. Adani Power plans to set up a 1,600 MW coal-based power project in Godda district and the entire power generated from the project would be supplied to Bangladesh through a dedicated transmission line.

Meanwhile, India’s Energy Efficiency Services Limited (EESL) signed an MoU with Bangladesh’s SREDA. As per the pact, EESL will set up street lights in Bangladesh and the cost of the installation will be borne by the Indian government.

Apart from this, three agreements were recently concluded for civil nuclear cooperation. The first deal is intended for mutual cooperation for peaceful use of nuclear energy between the two countries. The second one was signed by the Bangladesh Atomic Energy Commission and the Global Centre for Nuclear Energy Partnership, under India’s Department of Atomic Energy, for cooperation for nuclear power projects in Bangladesh. The third was between the atomic energy regulators of both countries for exchanging technical information and support the regulation of nuclear safety and radiation protection. Currently, Bangladesh is setting up its first nuclear power project, of 2,400 MW capacity, at Rooppur, which will be built with Russian reactors. Reportedly, Bangladesh wants to gain experience from the Kudankulam nuclear power plant in Tamil Nadu, which has been built with Russian support.

Issues and concerns

While there are a number of opportunities in the Bangladesh market, potential Indian investors would also have to factor in some risks. One of these is competition from the existing players. “The country already has some financially sound and technically competent private and publicly listed conglomerates with a presence in the power sector, which can provide significant competition to Indian investors,” notes Daruka.

He adds that existing Japanese and Chinese players in the country also pose stiff competition to Indian entrants and that many strategic procurement decisions are guided by bilateral funding sources, preferring suppliers and contractors from the country where financing originates. Besides these issues, the country as a whole has a weak business environment – with a rank of 176 out of 190 economies in the Doing Business 2017 survey – a fragile political environment, high terrorism risk and a difficult geopolitical outlook.

That said, enhancing private and foreign investment will be pivotal to putting Bangladesh’s fledgling power sector on track. Greater bilateral engagement between both governments, revision in electricity tariffs and the introduction of payment security mechanisms backed by the governments are some steps that experts feel could lend greater investor confidence. For Indian players, this is an exciting market in which they have an edge over other overseas investment destinations. As Pandit concludes, “Indian investors are uniquely placed and understand the socio-cultural, political and external environmental factors that play a major role in project execution.”