The Ujwal Discom Assurance Yojana (UDAY), the central government’s flagship programme aimed at achieving the financial turnaround of power distribution utilities, is making steady progress. Since its launch in November 2015, 26 states and the union territory (UT) of Puducherry have joined the scheme. Of these, 16 states have entered into comprehensive MoUs for both financial and operational improvement while the remaining 10 states and Puducherry have signed MoUs for operational efficiency only. While Odisha has in principle agreed to join the scheme, the states of West Bengal, Nagaland and Delhi as well as five UTs are yet to participate in it.

By 2019, the programme targets to achieve 15 per cent aggregate technical and commercial (AT&C) losses and a zero ACS-ARR (average cost of supply and average revenue realised) gap. Discoms in some UDAY states have started reaping the benefits through savings in interest costs and operational efficiencies. However, the programme is yet to have an impact in many states, about 10 of which have joined it over the past six to nine months and some of these are yet to implement the scheme to its fullest.

Power Line presents an analysis of the impact of UDAY on state discoms, based on various parameters…

Reduction in interest costs

- Of the total discom debt of Rs 4.3 trillion (as of September 30, 2015), Rs 2.7 trillion has been covered under the ambit of UDAY. Of this, states and discoms have issued UDAY bonds worth Rs 2.3 trillion so far. This has led to a sharp reduction in discoms’ interest costs. During the first nine months of 2016-17, these discoms achieved estimated savings in interest costs of Rs 120 billion. Rajasthan (Rs 51 billion), Uttar Pradesh (Rs 33 billion) and Haryana (Rs 21 billion) accounted for the majority of these savings. The Jharkhand, Punjab, Jammu & Kashmir, Andhra Pradesh, Bihar and Chhattisgarh discoms accounted for the remaining savings.

- Gujarat, Haryana and Chhattisgarh have shown positive profit trends during the first three quarters of 2016-17.

- Nine discoms across seven states – Andhra Pradesh, Bihar, Chhattisgarh, Goa, Haryana, Madhya Pradesh and Rajasthan – have reported reduced state subsidy dependence during the first three quarters of 2016-17.

Issuance of bonds

- For the 16 states that have signed comprehensive MoUs, the state governments will take over 75 per cent of the total outstanding debt of the discoms and issue bonds in the market or directly to the respective banks/ financial institutions holding the debt. The remaining 25 per cent debt would either be issued as a bond by the discom (guaranteed by the state government) or the terms of the loan would be changed by the banks. In return, discoms are required to undertake a series of reforms.

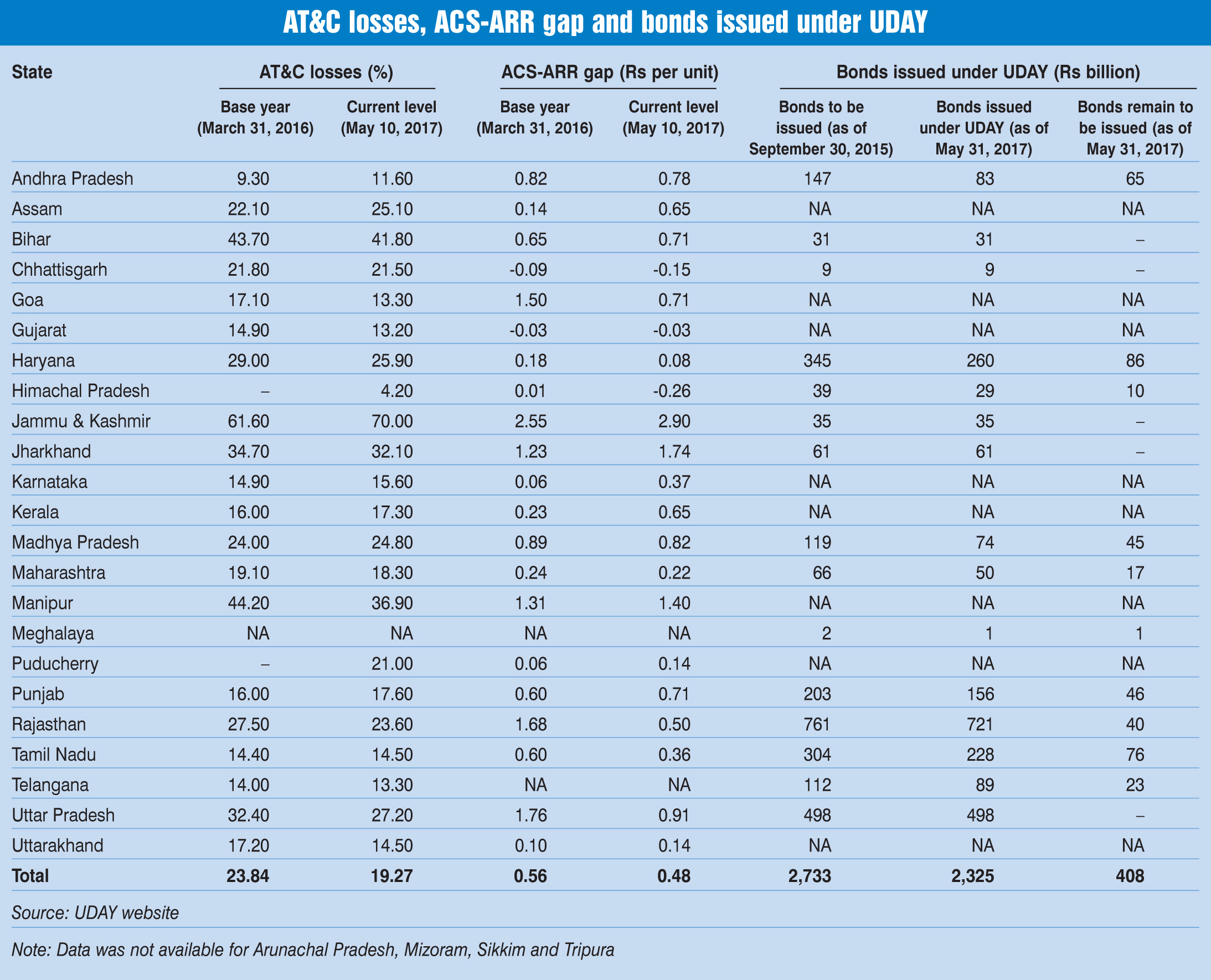

- As of May 31, 2017, total bonds worth Rs 2,325 billion have been issued by these states (state governments and discoms), accounting for over 85 per cent of the total bonds to be issued. Only the discoms of Punjab, Rajasthan and Uttar Pradesh have issued bonds (worth Rs 239 billion) so far. Meanwhile, five states – Uttar Pradesh, Chhattisgarh, Jharkhand, Bihar, and Jammu & Kashmir – have issued bonds for the entire amount committed by them under the scheme.

AT&C loss reduction

- Efforts are being made to achieve the 15 per cent AT&C loss reduction target. These include the segregation of feeders, replacement of faulty meters and installation of smart meters. While there has been an improvement in some states, the achievement so far has been short of the targets set under the scheme. Overall, AT&C losses stood at 19.27 per cent as of May 31, 2017 compared to 23.84 per cent as on March 31, 2016.

- States such as Goa, Rajasthan, Uttarakhand, Haryana and Uttar Pradesh have shown commendable improvement in their AT&C losses, with the first two surpassing their respective targets. On the other hand, states such as Andhra Pradesh, Karnataka, Kerala, Punjab, Madhya Pradesh, Assam, and Jammu & Kashmir witnessed an increase in their loss levels. Meanwhile, Himachal Pradesh, Andhra Pradesh, Telangana, Gujarat and Goa continue to register the lowest AT&C losses (below 14 per cent).

Tariff revisions

- Discoms of 25 states filed their petitions for the determination of tariffs for 2017-18. However, tariff orders have been issued for only 15 states (Bihar, Uttarakhand, Madhya Pradesh, Karnataka, Gujarat, Sikkim, Chhattisgarh, Andhra Pradesh, Manipur, Assam, Meghalaya, Maharashtra, Himachal Pradesh, Telangana and Mizoram). Of these, tariff hikes in the range of 2 per cent to 10 per cent have been approved for nine states. Bihar is an exception with a tariff increase of over 50 per cent. Other states, such as Gujarat, Maharashtra, Himachal Pradesh, Telangana, Sikkim and Mizoram, did not witness any tariff revision.

Decline in ACS-ARR gap

- Overall, tariff revisions have led to a reduction in the ACS-ARR gap, from Re 0.61 per unit in March 2016 to Re 0.49 per unit in December 2016. Twelve discoms reported an improvement in their gap reduction during the first three quarters of 2016-17 as compared to the previous year. Meanwhile, six discoms had a negative ACS-ARR gap in one or more quarters during 2016-17 (up to December 2016).

Decline in power generation costs

- The cost of coal-based power generation has reduced through various measures, including the substitution of imported coal, coal linkage rationalisation, coal swapping, third-party coal sampling and regradation of mines (to correct grade slippage). This is despite the increase in the cost of coal due to the increase in rail freight charges and the clean energy cess. For NTPC’s coal-based stations, the decrease in the cost of power generation has been around Re 0.26 per unit during 2016-17. This has resulted in net savings of over Rs 50 billion to the discoms. The gain due to regrading of mines has been 3.2 paise per unit. NTPC has also been assisting the state generation companies in improving their efficiency and reducing the cost of generation at their power plants.

- The total savings in power purchase costs amounts to over Rs 21 billion during the first nine months of 2016-17. These are Andhra Pradesh (through per unit savings of Re 0.35), Bihar (Re 0.16 per unit), Assam (Re 0.12 per unit), Haryana (Re 0.10 per unit) and Jharkhand (Re 0.08 per unit).

Improvements in metering

- There has been substantial progress in feeder metering. As of May 31, 2017, 97 per cent and 89 per cent of the feeders in urban and rural areas respectively have been metered across 22 UDAY states. The states still have to focus on improving distribution transformer (DT) metering and installing smart meters for high-consumption consumers. Only 34 per cent and 47 per cent of DTs have been metered in rural and urban areas respectively. And there is still a very long way to go for smart metering with only 1 per cent of the targeted number of meters installed so far.

Innovative solutions by states

- In order to meet the targets set under UDAY, several states have taken initiatives to improve the health of their discoms. These include Haryana’s “Mhara Gaon Jagmag Gaon” scheme, Rajasthan’s “Mukhya Mantri Vidyut Sudhar Abhiyan”, Manipur’s “Name and Shame” campaigns, as well as prepaid metering and spot billing by Haryana and Rajasthan.

Other parameters

- Besides metering, other operational parameters covered under UDAY include electricity access to unconnected households (74 per cent across 21 states), feeder segregation (55 per cent across 16 states), rural feeder audit (47 per cent across 22 states) and distribution of LEDs under the Unnat Jyoti by Affordable LEDs for All (UJALA) scheme (37 per cent across 22 states). There is significant room for improvement across all these parameters.

Issues and challenges

One of the major challenges in implementing the programme is the sharing of data by discoms. While 14 states are sharing substantial data regarding the progress across various parameters, the discoms of Jharkhand, Puducherry, Himachal Pradesh, Chhattisgarh, Jammu & Kashmir, and Telangana are providing only partial data. Tamil Nadu, which joined UDAY in January 2017, is yet to start data sharing. Meanwhile, other states like Sikkim, Meghalaya, Tripura, Mizoram, Arunachal Pradesh and Kerala that recently joined the UDAY club are also yet to start sharing information on the UDAY portal.

There is a deviation in the conversion of bond proceeds into equity or grants by the states from what was agreed to under the MoU in the case of Andhra Pradesh, Jharkhand, Tamil Nadu, Rajasthan and Assam. Further, the discoms of Uttar Pradesh, Telangana, Madhya Pradesh and Meghalaya are yet to provide any information with regard to the conversion of the bond proceeds. Another issue that the states need to take up on an urgent basis is smart metering. No perceptible progress has taken place in this area. The Ministry of Power (MoP) has expressed its willingness to hand-hold states under the aegis of the National Smart Grid Mission in this regard.

The MoP is also reviewing the progress under the programme through monitoring committee meetings. It has appointed KPMG for undertaking third-party audits of the MoUs. As compared to the previous schemes, UDAY has a more stringent monitoring framework in place and greater transparency in terms of performance. Further, the MoP is consciously making efforts to increase transparency across the value chain through various web applications and portals as well as mandatory electronic competitive bidding for power procurement and award of interstate transmission and generation projects.

Although UDAY holds the promise of achieving a discom turnaround, it still requires consistent effort and commitment on the part of the discoms. So far, the most significant impact of the programme has been the reorganisation of the discoms’ balance sheets. This has certainly given some respite to banks, which had been saddled with unsustainable debt that has now been replaced with high quality government debt. For the discoms, enhanced financial viability has made room for investments in infrastructure development and improvement in operational parameters. The key to achieving a turnaround is dependent on a major reduction in AT&C losses and closing the gap between the ACS and ARR.

Clearly, more substantial operational changes are needed for real reforms to kick in and ensure the success of the programme.