The Bombay Stock Exchange (BSE) power index tracks the share prices of 18 power companies operating across various segments of the industry. This index, which is weighted by free-float capitalisation, rose by 8.76 per cent from 2,079.29 points on September 1, 2016 to 2,261.46 on August 31, 2017. However, as compared to the same review period last year, the returns were relatively low with the power index companies recording a return of 34.23 per cent between September 1, 2016 and August 31, 2017.

CESC Limited, PTC India Limited, GMR Infra Limited and Adani Power were among the best performers during the review period. However, Reliance Power Limited and Reliance Infrastructure Limited registered negative returns of 20.9 per cent and 13.18 per cent respectively during same period. JSW Energy Limited, Bharat Heavy Electricals Limited (BHEL), and CG Power and Industrial Solutions Limited also reported negative returns.

An overview of the stock market performance of key power companies between September 1, 2016 and August 31, 2017, and analyses the trend of consolidated financials for 2016-17…

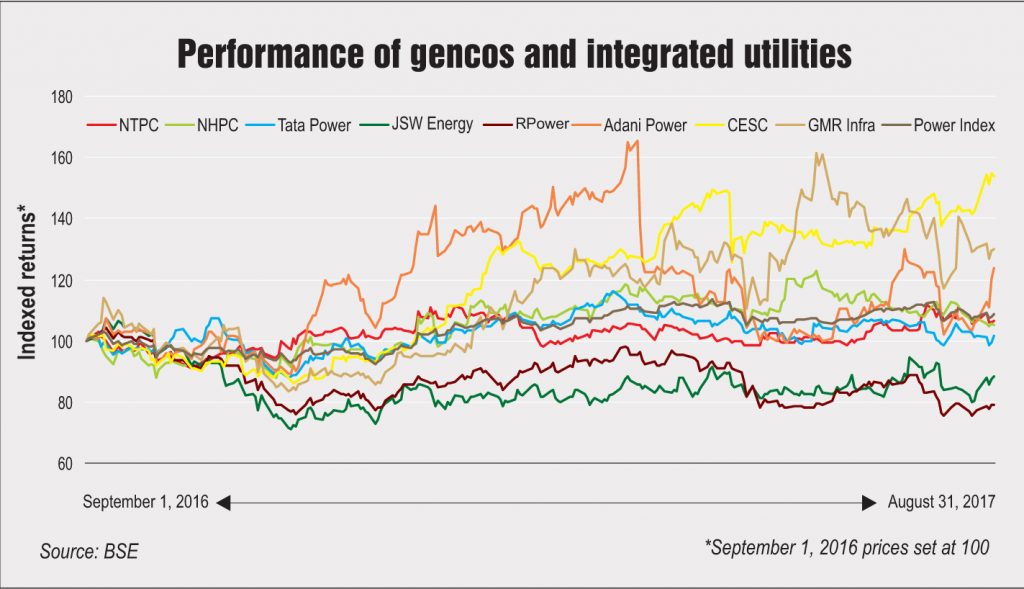

Generation companies

The stocks of generation companies recorded a reasonable return of 11.03 per cent (unweighted average) during the period under review.

India’s largest power utility, NTPC Limited, reported much lower returns, with its stock price increasing only 6.33 per cent compared to the 32.49 per cent rise in the previous year. The company saw continuous capacity addition with an increasing emphasis on renewables. NTPC crossed the 50 GW capacity milestone in March 2017, with the commissioning of the 500 MW Unchahar thermal power station in Uttar Pradesh.

NTPC added an aggregate capacity of 3,845 MW during 2016-17, including 325 MW through its subsidiary companies. As on September 1, 2017, the total installed capacity of the NTPC Group is 51,676 MW including 7,216 MW through joint ventures (JVs) and subsidiaries, across 40 NTPC stations (20 coal-based stations, seven combined cycle gas/liquid fuel-based stations and one hydro-based station), nine JV stations (eight coal based and one gas based) and 12 renewable energy projects. The company’s project pipeline includes around 20.9 GW of capacity, which is under construction. Of this, coal-based power plants constitute the majority share at 20.1 GW. Besides, the company plans to add 5,438 MW of capacity in the current fiscal year 2017-18.

During 2016-17, generation saw a marginal increase of 3.44 per cent compared to 2015-16 and stood at 250.3 billion units (BUs), the highest that NTPC has ever achieved. Meanwhile, its plant load factor (PLF) registered a performance of 78.59 per cent, which is almost at par with last year. This was better than the national average PLF of 59.88 per cent in 2016-17.

NTPC’s consolidated revenues increased by 11.5 per cent, from Rs 744.84 billion in 2015-16 to Rs 830.47 billion in 2016-17. However, its profit after tax (PAT) showed a marginal decline of 0.62 per cent and stood at Rs 107.31 billion in 2016-17, as compared to 107.8 in the previous year.

India’s largest hydropower producer, NHPC Limited, which has an aggregate installed capacity of 6,691 MW (including two power stations of 1,520 MW of NHDC Limited), witnessed a 5.23 per cent increase in its share price during the review period as against a 74.22 per cent increase during the same period last year. NHPC generated 23,275 MUs during 2016-17 compared to 23,683 MUs in the preceding year, while the overall plant availability factor stood at 83.41 per cent against 81.6 per cent during 2015-16. NHPC registered a growth of 7.2 per cent in its total income, from Rs 94.46 billion in 2015-16 to Rs 101.26 billion in 2016-17. Further, the company witnessed the highest ever net profit of Rs 27.61 billion in 2016-17, surpassing the previous year’s record of Rs 23.65 billion by 16.77 per cent. NHPC currently has a project pipeline of 3,130 MW that is under construction, of which 330 MW is expected to be commissioned in 2017-18.

Adani Power Limited registered an impressive increase of 23.84 per cent in its share price during the review period. The company has an installed capacity of 10,480 MW and plans to achieve 20,000 MW of capacity by 2020. It recorded consolidated revenues of Rs 232.02 billion, a decline of 9.84 per cent over 2015-16, primarily due to the non-recognition of compensatory tariffs (CT) for the Mundra plant by the Supreme Court and a reduction in the quantum of power sold. The net profit was also affected by the CT reversal since it recorded a loss of Rs 61.74 billion, against a profit of Rs 5.5 billion during 2015-16. The loss incurred was also due to an increase in imported coal prices. In a positive development, Adani Power secured over one-third of the coal auctioned under SHAKTI (Scheme for Harnessing and Allocating Koyala (Coal) Transparently in India) for two of its subsidiaries in the recently held auction.

Tata Power, the largest private sector power producer, has an aggregate installed capacity of 11,343 MW, including its subsidiaries and jointly controlled entities. During the period under consideration, Tata Power’s shares were up only marginally, by 1.48 per cent. The total revenue decreased by 5.04 per cent, from Rs 295.92 billion in 2015-16 to Rs 280.99 billion in 2016-17, primarily because of lower fuel and power purchase costs, resulting in lower tariffs. The company is exploring options to refinance debt and minimise the total cost incurred on debt servicing to make the Mundra plant financially viable.

A positive highlight during the year was the acquisition of Welspun Renewables Energy Private Limited by Tata Power Renewable Energy Limited in September 2016. The consolidated PAT saw an upward trend of 20.74 per cent from Rs 7.86 billion in 2015-16 to Rs 9.49 billion in 2016-17. This can be attributed to the larger contribution by coal mines and lower foreign exchange losses, which were partially counterbalanced by the loss towards contractual obligations owing to the purchase of shares in Tata Teleservices Limited. The company’s power generation, for the first time, crossed 52,000 MUs collectively from all its power plants in 2016-17, while its capacity reported a 16 per cent increase over the previous year.

JSW Energy Limited registered a negative return of 11.53 per cent in its stock price during the review period. The installed capacity stands at 4,531 MW (3,140 MW of thermal and 1,391 MW of hydel) with a long-term vision of achieving 10,000 MW capacity. JSW recorded a net generation of 21,631 MUs in 2016-17, against 22,064 MUs during the previous year, possibly because of a slowdown in demand in the sector. In addition, decline in generation and merchant tariffs along with rise in international coal prices affected JSW’s financial performance. JSW Energy recorded a total turnover of Rs 84.8 billion in 2016-17, a decrease of 15.71 per cent over the previous year, while net profits declined by 57.37 per cent to Rs 6.22 billion. Its PLF in 2016-17 improved to 66 per cent as against 75 per cent in 2015-16. Recently, the company revealed its plans to diversify into the electric vehicle manufacturing space and aims to roll out its first such vehicle by 2020.

GMR Infrastructure Limited, which has an operational capacity of 4,639 MW, saw an increase of 30.01 per cent in its share price during the review period. The GMR Group is engaged in infrastructure development with a portfolio comprising generation and transmission projects, airport operations, transportation and coal mines. A key development has been the investment of 30 per cent equity by Malaysia-based Tenaga Nasional Berhad in GMR Energy Limited for a cash consideration of $300 million in November 2016. Improved operational performances in the energy and airport sectors enhanced the financial performance of GMR, resulting in an increase in its consolidated total income from Rs 86.77 billion in 2015-16 to Rs 102.34 billion in 2016-17. Losses decreased from Rs 27.49 billion in 2015-16 to Rs 3.64 billion in 2016-17. During the year, GMR sold 74 per cent stake in the Maru project and 49 per cent in its Aravali project to Adani Transmission Limited for Rs 1 billion.

Reliance Power (RPower) witnessed a below-par performance and a decline in its share price by 20.9 per cent. However, the power plants displayed a strong operational performance during the review period. The company’s operational capacity stands at 5,945 MW. The company recorded a total income of Rs 108.91 billion in 2016-17, a marginal increase of 2.54 per cent from Rs 106.21 billion in 2015-16, which can be attributed to the improved performance of its thermal power plants. Its flagship thermal project, the 3,960 MW Sasan ultra mega power plant (UMPP) generated an impressive 29,476 MUs during the year with a PLF of 85 per cent. In addition, it posted a net profit of Rs 11.04 billion, as compared to Rs 8.95 billion in the previous year. However, the profit was affected by the Supreme Court’s order wherein it disallowed RPower to claim higher tariffs for the Sasan UMPP. A key highlight was signing an agreement with the Bangladesh government for setting up a 3,000 MW gas-based power project.

CESC Limited is a fully integrated power utility with operations spanning the entire power value chain, from coal mining to power generation and distribution. Investors remained bullish on CESC during the review period, with its share price increasing by 53.76 per cent, the highest amongst all the power index companies. The total consolidated revenues grew by 14.64 per cent, from Rs 123.87 billion in 2015-16 to Rs 142.02 billion in 2016-17. Its net profits recorded an increase of about 11.12 per cent, and stood at Rs 8.1 billion in 2016-17. A significant development for CESC during the year was securing a 20-year distribution franchise contract under competitive bidding for the Bikaner distribution area in Rajasthan, raising its total franchise tenders to three.

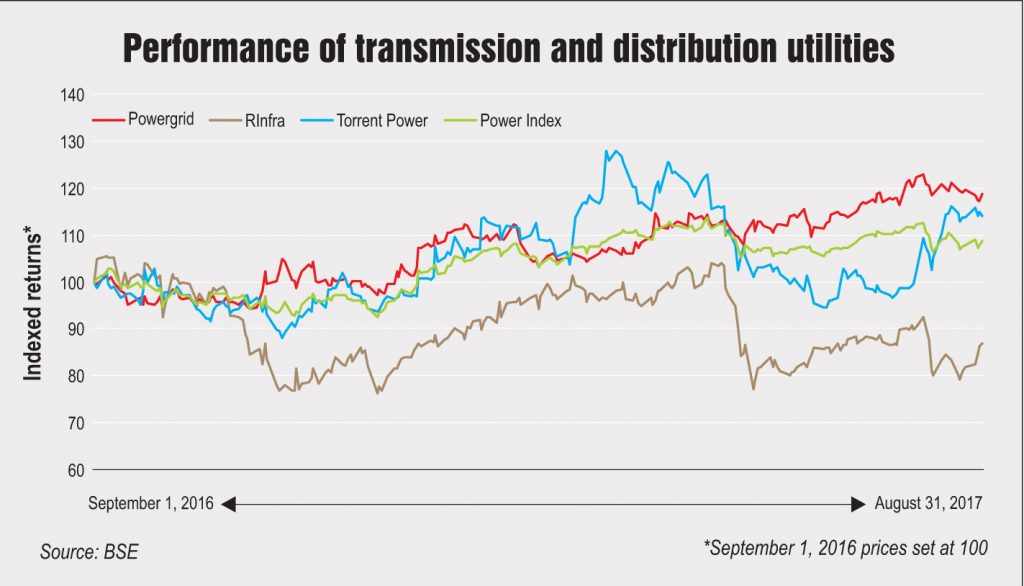

T&D utilities

The share prices of transmission and distribution (T&D) utilities, Power Grid Corporation of India Limited (Powergrid), Torrent Power and Reliance Infrastructure Limited (RInfra), reported positive returns of 6.46 per cent (unweighted).

Powergrid saw capital gains of 18.64 per cent. As of April 30 2017, the transmission assets owned and operated by Powergrid stood at 139,709 ckt. km of extra high voltage (EHV) transmission lines and 220 extra high voltage AC and high voltage direct current (HVDC) substations with about 292,543 MVA of transformation capacity. During 2016-17, the company maintained transmission network availability at 99.79 per cent, which is good even by international standards. The number of trips (unplanned) was contained to 0.68 per line during the year, indicating a high reliability of transmission systems. The company invested Rs 1,170 billion during the Twelfth Plan period with Rs 244 billion invested in 2016-17. Powergrid envisages an investment of Rs 1,000 billion during the Thirteenth Plan period (2017-22).

A number of important projects were commissioned during 2016-17 including Pole I of the ±800 kV Champa–Kurukshetra HVDC transmission system, which is a part of the western and northern HVDC interconnector for independent power producer projects in Chhattisgarh. Powergrid registered a total income of Rs 262.87 billion and a net profit of about Rs 74.5 billion during 2016-17, recording a growth of 24.48 per cent and 25.04 per cent respectively over 2015-16.

RInfra delivered a poor performance with a decline of share prices by 13.18 per cent during the period under consideration. The consolidated revenue stood at Rs 282.271 billion during 2016-17 while net profits rose by 101.36 per cent, from Rs 6.92 billion in 2015-16 to Rs 13.94 billion in 2016-17. RInfra’s order book status for engineering, procurement and construction contracts stood at Rs 59.6 billion as of March 31, 2017. Greenko is reportedly in talks with the company to acquire its Mumbai power business at an enterprise value of Rs 100 billion-Rs 130 billion.

During the period under consideration, Torrent Power’s share price increased by 13.91 per cent. Torrent has a generation capacity of 3,334 MW and distributes over 13 BUs of power annually to Ahmedabad, Gandhinagar, Surat, Dahej, Bhiwandi and Agra. In December 2016, the company signed a renewal and amendment agreement for the distribution of power in the Bhiwandi circle with Maharashtra State Electricity Distribution Company Limited. However, Torrent’s total income declined by 14.61 per cent, from Rs 119.97 billion in 2015-16 to Rs 102.44 billion in 2016-17. Meanwhile, net profits registered a 52.36 per cent decline, from Rs 9.02 billion to Rs 4.29 billion.

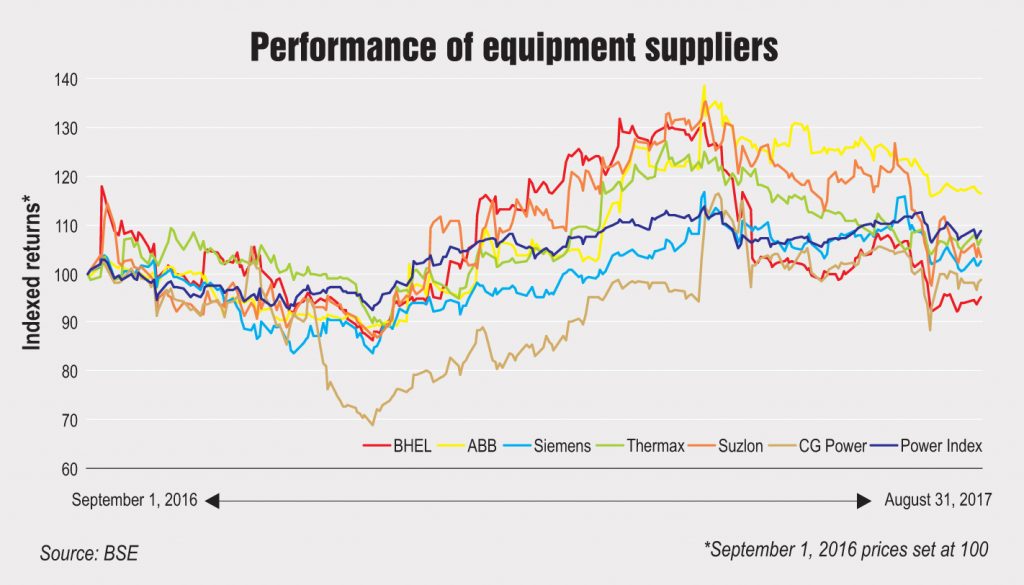

Equipment suppliers

Power equipment manufacturers such as Bharat Heavy Electricals Limited (BHEL), CG Power and Industrial Solutions Limited, ABB India, Thermax, Siemens and Suzlon registered an average return of 3.86 per cent (unweighted) during the review period.

Siemens’ share price saw an increase of 2.56 per cent. Its income increased by 2.57 per cent (for the year ended September 30, 2016), from Rs 107.23 billion in 2015-16 to Rs 109.99 billion. The company posted a net profit of Rs 28.73 billion during 2016-17, which marked a 144.69 per cent increase over the Rs 11.74 billion in 2015-16. One of the major orders received was the $520 million (Rs 34 billion) project from Powergrid to supply equipment for the ±320 kV Pugalur– Thrissur (Kerala) HVDC system.

BHEL registered a capital loss of 4.79 per cent. However it secured orders worth Rs 234.89 billion during 2016-17, which include a major order from Powergrid for ±800 kV, 6,000 MW HVDC terminals associated with the HVDC bipole link between the western and southern grids of India and an export order of Rs 100.47 billion from the 1,320 MW Maitree superthermal power project, Bangladesh. BHEL secured orders worth Rs 72.61 billion from the power sector, which indicated a decline of 81.15 per cent since last year primarily due to subdued market demand coupled with intense competition in the domestic and overseas markets. During 2016-17, BHEL commissioned/synchronised 8,570 MW of power generation equipment including the commissioning of six supercritical units. It reported total revenue of Rs 304.89 billion in 2016-17, an increase of 8.29 per cent, and recorded a net profit of Rs 4.55 billion as against a net loss of Rs 7.05 billion in 2015-16.

ABB India Limited saw capital gains of 16.31 per cent in its stock price. The company received orders worth Rs 124.66 billion during 2016 as against Rs 81 billion in 2015. One of the major orders received by ABB India during 2016 was a Rs 43.5 billion order from Powergrid to deliver the 800 kV Raigarh-Pugalur UHVDC system. The total revenue for 2016 (January-December) increased by 6.87 per cent to Rs 87.13 billion while the net profit rose by 25.47 per cent to Rs 3.76 billion during the same period. A key highlight was the powering up and automation of the world’s largest single-location solar project, the 648 MW Kamuthi project of Adani Power in Tamil Nadu.

CG Power and Industrial Solutions Limited recorded marginally negative returns of 1.23 per cent. During 2016-17, the company reported an increase of 8.45 per cent in its consolidated net income, from Rs 57.06 billion in 2015-16 to Rs 61.88 billion. However, it saw an increase in its net loss, which stood at Rs 4.9 billion in 2016-17 as against Rs 4.6 billion in the previous year. The company’s financial performance was influenced by relatively poor overseas operational performance. However, the order book stood at Rs 46.9 billion as of March 31, 2017, which marked an increase of 7.9 per cent over the previous year, mainly because of an improvement in power system orders. During 2016-17, the company stepped on its restructuring efforts, hiving off its structurally loss-making entities. It sold its automation business in March 2017. However, the deal to sell its T&D business in Europe, North America and Indonesia could not fructify as CG Power terminated its share purchase agreement with private equity firm First Reserve International Limited. It also withdrew from the distribution franchise agreement for the Jalgaon circle in Maharashtra.

Thermax recorded capital gains of 6.8 per cent during the review period. However, the consolidated total income decreased by 12.71 per cent, from Rs 53.88 billion in 2015-16 to Rs 47.03 billion in 2016-17. The net profit also saw a downtrend from Rs 3.23 billion in 2015-16 to Rs 2.81 billion in 2016-17. The deficit in revenue was primarily due to challenging market conditions and lack of big domestic orders. Thermax set up a manufacturing unit in Indonesia with an investment of $25 million to expand its business in the Southeast Asian market. It also commissioned an 18 MW plant in Rajasthan, which generates power from cement waste heat, the largest of its kind in India. Other highlights included a tie-up with a Denmark-based company for emission control solutions.

Suzlon Energy Limited recorded marginal capital gains of 3.50 per cent. The company posted net profits of Rs 8.51 billion in 2016-17 against Rs 5.83 billion in 2015-16. Its income saw an increase of 33.63 per cent, from Rs 95.81 billion in 2015-16 to Rs 128.03 billion in 2016-17. Suzlon saw an increase in commissioned volume in 2016-17 by 97.7 per cent and stood at 1,779 MW. It received orders worth Rs 40.45 billion as of March 2017.

Trading companies

Leading power trading company PTC India Limited delivered a strong performance, with capital gains of 44.22 per cent. The company posted a 24.5 per cent increase in its net profit (Rs 5.05 billion) and a 14.06 per cent increase in its total income (Rs 155.13 billion) in 2016-17. The trading volumes were higher by 14 per cent in 2016-17 at 48.32 BUs as against 42.38 BUs in the previous year, contributed by cross-border transactions. In July 2017, PTC India signed power purchase agreements for 1,050 MW of wind capacity awarded in the first round of the wind power auction. It also signed an MoU with the New and Renewable Energy Department, Government of Madhya Pradesh, for the joint development of 500 MW of solar projects in the state.

Conclusion

The outlook for the power sector seems positive despite challenges. The sector has gained momentum over the past year on the back of central government initiatives. The Ujwal Discom Assurance Yojana will play a crucial role in improving the financial performance of loss-making state distribution utilities. The generation companies face challenges owing to high imported coal prices and inability to charge compensatory tariffs for their plants. The sector’s performance was below par primarily due to subdued market conditions. Many utilities are now expanding their renewable capacities and operations outside India in order to diversify business risks.