With an installed hydropower capacity of 6,641 MW, NHPC is the largest hydropower generator in the country. The central sector utility accounts for nearly 15 per cent share in the country’s total installed hydropower capacity of 44,963 MW (as of January 2018). While NHPC has been involved in the entire hydropower development value chain, from concept to commissioning, over the years, it has recently diversified into new fuel sources including renewable energy (solar and wind) and thermal power. Going forward, it is targeting to build a portfolio of almost 10,000 MW of projects by 2022.

At a recent Power Line conference, Balraj Joshi, chairman and managing director (CMD), NHPC, said, “We have a fairly good laid-out future plan, and the issues and challenges concerning hydropower are being discussed at various levels so that our plans of becoming a 10,000 MW company by 2022 fructify.”

Operational project portfolio

NHPC’s operational projects include 21 hydroelectric projects (HEPs) aggregating 6,641 MW across various states including Jammu & Kashmir (2,009 MW), Himachal Pradesh (1,771 MW), Sikkim (570 MW), Uttarakhand (400 MW), West Bengal (292 MW) and Manipur (105 MW). In addition, NHPC operates two HEPs totalling 1,520 MW in Madhya Pradesh through its joint venture (NHDC Limited) with the Madhya Pradesh government. Further, the company operates the 50 MW Lakhmana wind power project in Rajasthan, which was commissioned in 2016.

NHPC’s total generation during 2017-18 (till January 2018) stood at 21,033 MUs (stand-alone, excluding NHDC’s generation), about 3.3 per cent higher than the corresponding period in the previous year. During 2016-17, its generation had stood at 23,275 MUs, which was almost the same as the previous year.

Projects under construction

NHPC is currently constructing four HEPs totalling 4,130 MW, the largest being the 2,000 MW Subhansiri Lower project on the Assam-Arunachal Pradesh border. Besides, the 1,000 MW Pakal Dul HEP in Jammu & Kashmir, the 800 MW Parbati II in Himachal Pradesh and the 330 MW Kishanganga in Jammu & Kashmir are under construction.

However, work on the Subhansiri Lower HEP has been stalled owing to local protests and downstream issues. Joshi explains, “The locals are objecting because the project is located on Assam’s border but the state is not getting any benefit. We have taken measures to address public concerns regarding dam safety, seismicity issues and flooding apprehensions. But the matter refuses to settle and consequently, an investment of Rs 95 billion has been sitting idle for four to five years.”

Meanwhile, the Kishanganaga HEP (first unit) is expected to be commissioned by March 2018 and the Parbati II HEP by December 2018. In addition, the company is constructing a 50 MW solar power project in Tamil Nadu, which is expected to be commissioned by March 2018. Further, the Pakla Dul HEP is expected to be commissioned in 2023. It is being developed by Chenab Valley Power Projects Private Limited (CVPPL), a joint venture between NHPC, Jammu and Kashmir State Power Development Corporation, and PTC India in the ratio 49:49:2.

Issues and challenges

Despite extensive experience in hydropower development, NHPC, like other players in the sector, faces the challenge of time- and cost-overruns. This is owing to inaccessible project locations, geological uncertainties and natural calamities such as landslides and earthquakes, which lead to significant delays in the construction of projects. Besides, there is a dearth of contractors that can deliver, especially at remote hydro sites, which increases the company’s dependence on a few contractors. In addition, stringent norms for obtaining environmental and forest clearances are a major issue in HEP execution. Joshi says, “It is ironical that environmentally benign hydropower projects are facing the maximum wrath of environmentalists. The environmentalists are not wrong; perhaps we have historically erred in planning HEPs in an environmentally responsible manner, which is why stringent guidelines and rules have now been thrust upon the segment.”

Further, the capital-intensive nature and long gestation period of HEPs result in higher tariffs during the initial years of operations, which adversely affect power despatch from such projects. For instance, the company’s Nimmo Bazgo HEP in Jammu & Kashmir has a tariff of Rs 9.31 per kWh for 2017-18, the Chutak HEP (Rs 8.27 per kWh) and the Teesta Low Dam Project III (Rs 6.20 per kWh). Meanwhile, the tariff for other operational HEPs for 2017-18 ranges from Rs 1.98 to Rs 5.57 per kWh. Besides, there are several technical issues in executing new projects as all the feasible sites have already been exploited. This is compounded by the lack of manpower for executing HEPs, which require multidisciplinary skills pertaining to hydrology, earthquake engineering, geology, etc.

Other issues include intra-state water sharing disputes, upfront charges and additional power demands by states. For instance, Arunachal Pradesh seeks an upfront charge for HEPs, which adds to the overall project cost.

All these issues have added to the hydro sector’s woes and made it non-competitive. “This is the reason that, despite the overall installed capacity having grown by more than 14 per cent, hydropower has grown by only 5 per cent or less in the past few years,” notes Joshi.

Financial performance

NHPC’s revenue has recorded steady growth in the past few years owing to the increase in the generation and sale of power. Its revenue (consolidated) grew at a compound annual growth rate (CAGR) of 5 per cent, from Rs 87.38 billion in 2013-14 to Rs 101.27 billion in 2016-17. During the same period, the company’s net profit nearly trebled from Rs 12.18 billion to Rs 34.8 billion. NHPC’s strong financial performance has enabled it to invest in large capital-intensive HEPs. The company incurred a capex of about Rs 144 billion between 2012-13 and 2016-17.

Project pipeline

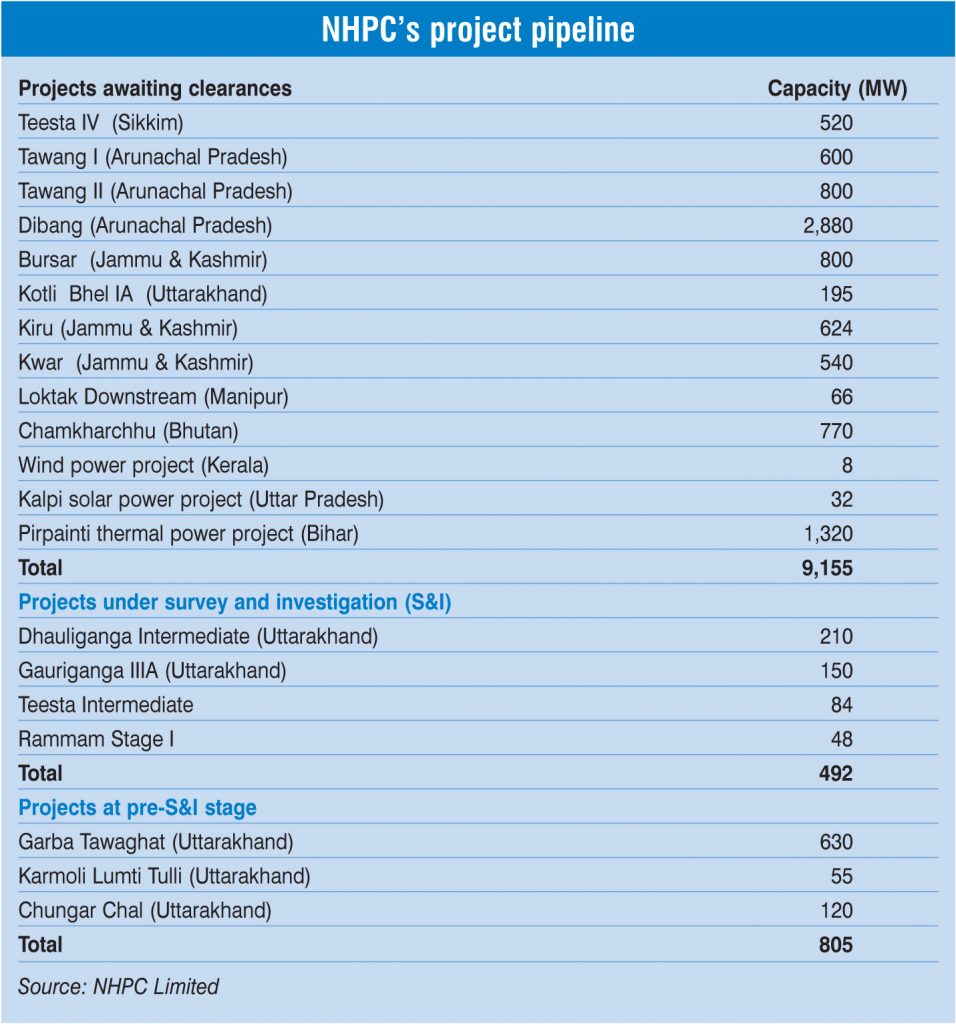

Aside from the capacity under construction, NHPC’s project pipeline comprises about 9,155 MW of hydro, renewable and thermal projects that are currently awaiting clearances. Of the 10 HEPs awaiting clearances, six, aggregating 5,795 MW – Kotli Bhel IA, Teesta IV, Dibang, Bursar, Tawang I and Tawang II – are being executed by NHPC on a stand-alone basis and the rest in the JV mode. The JVs include CVPPL, which will execute the Kiru (624 MW) and the Kwar (540 MW) HEPs in Jammu & Kashmir. The company also has a JV with Bhutan-based DRUK Green Power Corporation to implement the Chamkharchhu HEP (770 MW) in Bhutan and a JV with the Manipur government to implement the Loktak Downstream HEP (66 MW). In addition, an 8 MW wind power project in Kerala and the 32 MW Kalpi solar project in Uttar Pradesh (in JV with the state government) are also awaiting clearances.

NHPC’s maiden upcoming thermal power project – the 1,320 MW Pirpanti supercritical project – in Bihar is also awaiting statutory clearances and coal allocation. The project is being developed through a JV between NHPC and the Bihar government, with NHPC holding 74 per cent stake. Further, the company has 492 MW of capacity under survey and investigation (S&I) and 805 MW at the pre-S&I stage (wherein discussions with the state governments regarding project sites are under way).

The road ahead

For 2017-18 and 2018-19, the company expects to incur a capex of Rs 30.89 billion and Rs 33.43 billion respectively. The capex is expected to increase further after active resumption of construction works at the Subhansiri Lower project and award of clearances to the upcoming projects.

In order to accelerate project construction, NHPC is looking at leasing land, rather than acquiring it, from the state governments. However, only some states have provisions for leasing land and the maximum available lease period is 25 years while the economic life of HEPs is typically around 35 years. The company is in discussions with various states on this matter.

To fast-track HEP development, Joshi has a wishlist for policymakers: “The procedure for resettlement and rehabilitation should be simplified, the states should share the cost of basic infrastructure facilities and security, and low-cost institutional credit should be provided to the hydro sector, among others. Also, there is a need to redefine the stakeholders of HEPs as was done in previous large-scale projects like the Bhakra dam.”

Given its established track-record in implementing HEPs, strong operational and financial performance, and expert in-house engineering capabilities, NHPC is expected to resolve the challenges and continue to play a leading role in boosting hydropower in the country.

With inputs from a presentation by Balraj Joshi, Chairman and Managing Director, NHPC Limited, at a recent Power Line conference