Metering, billing and collection are crucial areas for distribution utilities as they play a key role in energy accounting and revenue management. Given the deteriorating operational and financial performance of distribution utilities, it is imperative that steps are taken to arrest losses through advanced metering technologies. In recent years, the central government is aggressively focusing on smart metering under various schemes and programmes. The government’s recently launched scheme, the Revamped Distribution Sector Scheme (RDSS), which has an outlay of over Rs 3.03 trillion, also lays focus on smart metering. Around 100 million prepaid smart meters are proposed to be installed by December 2023 in the first phase. The states are also taking steps to improve their performance in high-loss circles by appointing distribution franchises and unveiling other state-sponsored programmes.

Power Line presents an overview of the distribution segment’s performance, the metering status under various government programmes as well as metering initiatives by distribution franchises….

Distribution segment overview

Driven by increasing power demand and electrification across the country, the distribution network has been growing steadily in terms of line length and transformer capacity. The distribution line length and transformer capacity have grown at a compound annual growth rate (CAGR) of about 5 per cent and 6 per cent, respectively, in the past five years. As of March 2021, the distribution line length stood at about 13.5 million ckt km. Utility-wise, the state-owned discoms of Maharashtra and Tamil Nadu had the largest distribution networks.

As per the recently released Report on Performance of Power Utilities 2021 by the Power Finance Corporation, the gross energy sold by distribution utilities stood at 1,005 BUs in 2020-21, registering a year-on-year decrease of 1.88 per cent over 1,024 BUs in 2019-20. The revenue from power sale (including tariff subsidy billed) also declined by 1.76 per cent to Rs 6,325.43 billion from Rs 6,438.81 billion during the same period.

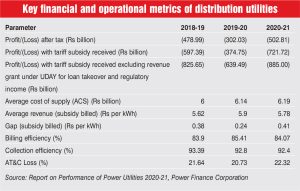

Regarding the financial performance, the aggregate losses for distribution utilities increased from Rs 302.03 billion in 2019-20 to Rs 502.81 billion in 2020-21. The aggregate losses on tariff subsidy received basis (excluding regulatory income and revenue grant under the Ujwal Discom Assurance Yojana [UDAY] for loan takeover) also recorded an increase from Rs 639.49 billion in 2019-20 to Rs 885 billion in 2020-21. Further, the overall aggregate technical and commercial (AT&C) losses for distribution utilities grew from 20.73 per cent in 2019-20 to 22.32 per cent in 2020-21.

Metering progress under government programmes

Smart metering is being actively promoted by the National Smart Grid Mission (NSGM), the Smart Metering National Programme (SMNP), the Integrated Power Development Scheme (IPDS), RDSS, smart grid pilots and utility initiatives, among others. Powered by advanced metering infrastructure (AMI), smart meters enable two-way communication between the utility and consumers and enable the collection and transfer of energy usage information in near real time. The AMI comes with a range of capabilities such as load management, outage handling, remote meter reading, remote connect and disconnect, self-diagnosis, automated and timely billing and a prepayment option.

As of October 2022, a total of 11.3 million smart meters have been sanctioned under various schemes including the utility’s own initiatives, while 5.07 million smart meters have been installed. Uttar Pradesh has the highest number of installed smart meters in the country, at nearly 1.16 million, followed by Bihar (1.14 million).

The majority of meters, over 3.7 million, have been installed under utility initiatives, both public and private, with the balance having been implemented under various government pilot schemes. The majority of these smart meters (3 million) have been installed by Energy Efficiency Services Limited (EESL), a government joint venture energy service company that is spearheading the smart metering drive, with an ambitious target of replacing 250 million conventional meters with smart meters under the SMNP. EESL has also formed a joint venture with the National Investment and Infrastructure Fund and IntelliSmart Infrastructure Private Limited, to implement, finance and operate the smart meter roll-out programme for discoms. It will enable the implementation of smart meters through the BOOT (build, own, operate and transfer) model to expedite deployment, replicating EESL’s success so far on the same model. The focus of IntelliSmart would be to drive efficiencies for discoms, improve revenue management, increase billing efficiency and consumer satisfaction. With the replacement of 250 million conventional meters with smart meters, billing and collection efficiency can improve to 100 per cent and has the potential to increase discom revenues by Rs 1,000 billion annually.

Focus on distribution franchises

Distribution utilities often hand over certain areas to distribution franchisees (DFs) in order to reduce AT&C losses or turnaround performance through improvement in metering, billing and collection practices as well as distribution network modernisation through a host of other measures. At present, there are around 12 distribution franchisees operating in different circles/divisions across the states of Maharashtra, Uttar Pradesh, Rajasthan, Meghalaya and Tripura. Of these, CESC Limited holds four DF contracts (Kota, Bharatpur, Bikaner and Malegaon), Torrent Power Limited holds three DF contracts (Bhiwandi, Agra, and Shil, Mumbra and Kalwa), Feedback Electricity Distribution Company Limited (certain electricity divisions in Meghalaya and Tripura) and Sai Computers (Dalu and Kailashahar) hold two contracts each and Tata Power holds one such contract (Ajmer).

Most existing DFs have been successful in reducing AT&C losses through a host of measures such as adequate metering, accurate billing and collection, technology adoption and other operational measures. For instance, Torrent Power has been successful in reducing AT&C losses in Bhiwandi from 58 per cent in 2006-07 to 16.22 per cent in 2020-21. Similarly, it has reduced AT&C losses in Agra from 54.3 per cent in 2011-12 to 13.5 per cent in 2020-21. In Agra, Torrent Power took initiatives such as replacement of over 0.3 million static electronic meters with smart meters of state-of-the-art technology and high accuracy; roping in a third party for random testing of meters at the site; and meter-based billing instead of assessed billing. Even in Shil, Mumbra and Kalwa, which is a relatively recent area to be franchised, transmission and distribution (T&D) losses were reduced to 44.89 per cent from 55.02 per cent in 2019-20 by Torrent Power.

Likewise, since takeover of operations as a DF in Kota in 2016-17, CESC has managed to reduce T&D losses from 32 per cent to 21.8 per cent. Tata Power also took steps to replace static meters with electronic ones in Ajmer, after it took over franchisee operations. Tata Power Ajmer Distribution Limited’s AT&C losses in Ajmer increased slightly from 9.96 per cent in 2019-20 to 10.21 per cent in 2020-21, but are quite low relative to other franchised areas.

However, despite the benefits, the distribution franchise model has not gathered momentum amongst state distribution utilities, partly due to a perceived threat of “privatisation” among employees. Also, there are issues such as the limited scope for regulatory intervention in DF contracts and the inadequate dispute resolution mechanism.

The way forward

Going forward, the pace of smart meter installation is expected to accelerate, bolstered by the push from the central government. In addition, the benefits demonstrated by smart meters during the Covid crisis are encouraging an increasing number of discoms to come forward and adopt the new technology.