The 11th Annual Integrated Rating and Ranking of Power Distribution Utilities report was released recently. The exercise, conducted with Power Finance Corporation Limited as the nodal agency, covers 71 power distribution utilities, comprising 45 state discoms, 14 private discoms and 12 power departments across India. Broadly, the rating methodology evaluates the performance of discoms against three main parameters – financial sustainability (75 per cent weightage), performance excellence (13 per cent weightage), and external environment (12 per cent weightage). The 11th integrated rating exercise methodology tracks 15 base rating metrics and nine disincentives, together contributing to a score out of 100, to holistically capture every discom’s performance. Based on these scores, the discoms are then assigned grades.

As per the 11th rating exercise, the financial deficit of the discoms has nearly halved in 2021-22 over 2019-20, despite an 8 per cent increase in gross input energy. The national absolute cash-adjusted gap in the distribution segment was recorded at Rs 530 billion in 2021-22. Meanwhile, the total debt increased by 24 per cent to Rs 6.2 trillion in 2021-22 from 2019-20. The sector’s total liquidity gap is nearly Rs 3.03 trillion. The discoms’ current liabilities of Rs 6.63 trillion exceed their overall current assets of Rs 5.57 trillion, and are almost twice the value of their current liquid assets of Rs 3.61 trillion.

Key findings

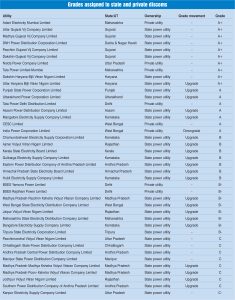

Rankings: The scores and grades of discoms have shown significant improvement in the 11th ratings over the previous version. Of the 57 state and private discoms covered in the 11th ratings, 46 saw improved scores, with 39 of them improving their scores by more than 5 per cent. Of the remaining 11 discoms, eight saw their scores decline by over 5 per cent. Twenty-four discoms saw their grades improve, and only one discom has been downgraded. The number of discoms awarded a grade of C or lower fell from 35 to 21. Eleven discoms have been rated A+, as against 12 in 2020-21. These discoms are private utilities under Adani Electricity Mumbai Limited, Noida Power Company Limited, Tata Power Limited – Mumbai, and TP Western Odisha Distribution Limited; four state-owned discoms from Gujarat and two from Haryana; and DNH Power Distribution Corporation Limited. Eight discoms were rated A, compared to four in 2020-21. Nine have been rated B, and eight have been rated B-. Furthermore, eight discoms have been rated C and 12 have been rated C-. One discom has been rated D.

Of the 12 power departments covered in the 11th ratings, one each has been awarded grades of B and B-. Meanwhile, three have received a C grade, and seven have been rated C-.

A comparison of the current and previous rankings highlights the cash-adjusted average cost of supply (ACS)-average realisable revenue (ARR) gap as the biggest contributing factor to a rise or fall in ratings. The ACS-ARR gap carries a weightage of 35 points (out of 100) for discoms and 55 (out of 100) for the power departments.

State of the sector: The Indian power sector has accomplished various feats such as achieving universal electrification, creating a national grid, launching power exchange markets, and generating surplus power. Despite these, the sector is battling significant challenges, particularly in the distribution segment. This segment is facing financial losses, and rising debt and dues to power generators. The government is addressing these issues through major reforms such as the Revamped Distribution Sector Scheme; the Late Payment Surcharge Rules, 2022; additional prudential norms for lending by financial institutions; the national smart grid mission; and mandatory energy accounting and auditing. While these programmes have reinvigorated the sector, some of the larger legacy issues will need more time and interventions to be resolved.

In terms of financial performance, power distribution entities had recorded a loss of 79 paise per unit of energy in 2019-20, which fell to just 40 paise per unit in 2021-22. The state discoms of Rajasthan, Maharashtra, Karnataka, Madhya Pradesh and West Bengal improved their performance the most, and reduced their absolute cash-adjusted gap by about Rs 430 billion from 2019-20 to 2021-22. Further, shortfalls in cash collection improved from Rs 380 billion in 2019-20 to Rs 240 billion in 2021-22; and profit before tax rose by about Rs 80 billion between 2019-20 and 2021-22, helped by an increase in non-tariff subsidies.

Some improvements in the power distribution segment recorded during 2021-22 include a higher aggregate subsidy disbursal than the subsidy booked, and improved collection efficiency, supported by improved subsidy disbursal by state governments and better customer collections by discoms. The government has taken over discom loans from 2019-20 to 2021-22, which have been converted into equity, thus easing debt obligations. Thirty-five of 69 discoms have implemented auto-pass-through of fuel costs. This is especially important in the context of rising coal and natural gas prices, as it ensures that these discoms shall pass on the rising fuel costs to consumers and retain their financial sustainability.

In terms of operational performance, the AT&C loss levels have fallen to 16.5 per cent in 2021-22, almost 5 per cent lower than in 2020-21 and 3 per cent lower than in 2019-20. Forty-four utilities have improved their AT&C losses, of which 19 saw the losses decrease by about 5 per cent compared to the 2019-20 levels. Meanwhile, collection efficiency rose from 93.1 per cent in 2019-20 to 97.2 per cent in 2021-22; and billing efficiency remained constant at about 86 per cent during the same period.

There is still scope for improvement in metrics such as days payable, which has fallen from 175 days in 2020-21 to 163 in 2021-22, but can be reduced further; and days receivable, which fell significantly from 157 days to 142 in the same period, but is still higher than the benchmark levels. Further, subsidy arrears stood at Rs 660 billion at the end of 2021-22. The total sectoral debt has increased by 24 per cent to Rs 6.2 trillion from 2019-20 to 2021-22. However, the pace of debt addition has slowed considerably, and the debt service coverage ratio turned positive in 2021-22 at 0.43 from -0.07 in 2019-20, driven by a higher cash-adjusted EBITDA.

As for distribution losses, 33 utilities did not achieve the targets set by their respective state electricity regulatory commissions in 2021-22. The sector’s regulatory assets have remained stagnant from 2019-20 to 2021-22, at Rs 1.6 trillion, highlighting the need for greater state efforts through appropriate tariff increments, capital support and efficiency measures. Five states, namely, Tamil Nadu, Rajasthan, Delhi, Maharashtra and Kerala, have contributed heavily to the sector’s regulatory assets. To address this challenge, states are being pushed to formulate liquidation plans and not create new regulatory assets going forward.

The way forward

A set of best practices has also been identified for discoms to follow in order to improve their billing and collection efficiencies and manage working capital better. These include digitising bill generation and payment, employing advanced meter-reading capabilities, leveraging analytics to reduce theft and fraud, investing in technological capabilities, deploying enterprise resource planning systems and robotic processes to automate regular processes, optimising key performance indicators and improving accounting processes.

Overall, the power distribution segment displayed several green shoots in 2021-22, including recovery from Covid-19. However, there is a long way to go for the sector to turn around. The areas that need immediate attention include profitability, debt-clearing, improvement of the billing process, and solutions for the liquidity crunch. Further, revamping certain discom operations that contribute heavily to the sector’s financial distress can significantly improve the performance of the sector. N